Ecosyste.ms: Awesome

An open API service indexing awesome lists of open source software.

https://github.com/Spreads/Spreads

Series and Panels for Real-time and Exploratory Analysis of Data Streams

https://github.com/Spreads/Spreads

cep data-stream real-time series-manipulation time-series

Last synced: 18 days ago

JSON representation

Series and Panels for Real-time and Exploratory Analysis of Data Streams

- Host: GitHub

- URL: https://github.com/Spreads/Spreads

- Owner: Spreads

- License: mpl-2.0

- Created: 2015-12-20T20:10:03.000Z (over 8 years ago)

- Default Branch: main

- Last Pushed: 2023-04-16T20:28:15.000Z (about 1 year ago)

- Last Synced: 2024-04-23T10:01:31.427Z (30 days ago)

- Topics: cep, data-stream, real-time, series-manipulation, time-series

- Language: C#

- Homepage: http://docs.dataspreads.io/spreads/

- Size: 18 MB

- Stars: 419

- Watchers: 40

- Forks: 37

- Open Issues: 12

-

Metadata Files:

- Readme: README.md

- License: LICENSE.Dependencies.txt

Lists

- awesome-dotnet - Spreads - Series and Panels for Real-time and Exploratory Analysis of Data Streams. Spreads library is optimized for performance and memory usage. It is several times faster than other open source projects. (Machine Learning and Data Science)

- awesome-dotnet-core - Spreads - Series and Panels for Real-time and Exploratory Analysis of Data Streams. (Frameworks, Libraries and Tools / Machine Learning and Data Science)

- awsome-dotnet - Spreads - Series and Panels for Real-time and Exploratory Analysis of Data Streams. Spreads library is optimized for performance and memory usage. It is several times faster than other open source projects. (Machine Learning and Data Science)

- awesome-dot-net-performance - Spreads - "Series and Panels for Real-time and Exploratory Analysis of Data Streams", a library for fast time series incremental calculations + SIMD-optimized byte-shuffling/LZ4/Zstd compression using [Blosc](https://github.com/Blosc/c-blosc/) library. (High Performance Libraries / Application Insights)

README

# Spreads.Core

Spreads.Core contains several high-performance features: buffer pools, optimized binary/interpolation search, collections, threading utils, etc.

-----------------------------------

**The "series and panels" part of the library is under very slow rewrite**

**Below is a very old readme**

# Spreads

The name **Spreads** stands for **S**eries and **P**anels for **R**eal-time and **E**xploratory **A**nalysis of

**D**ata **S**treams.

+ **Data Streams** are unbounded sequences of data items, either recorded or

arriving in real-time;

+ **Series** are navigable ordered data streams of key-value pairs;

+ **Panels** are series of series or data frames;

+ **Exploratory** data transformation in C#/F# REPLs;

+ **Real-time** fast incremental calculations.

Spreads is an ultra-fast library for [complex event processing](https://en.wikipedia.org/wiki/Complex_event_processing)

and time series manipulation.

It could process tens of millions items per second per thread - historical and real-time data in the

same fashion, which allows to build and test analytical systems on historical data and use

the same code for processing real-time data.

Spreads is a [library, not a framework](http://tomasp.net/blog/2015/library-frameworks/), and could

be plugged into existing code bases and used immediately.

Even though the primary domain is financial data, Spreads was designed as a generic complex event processing library,

with a performance requirement that it must be suitable for ticks and full order log processing.

This is probably the largest data stream that cannot be meaningfully sharded: financial instruments

are all directly or indirectly correlated and we need to monitor markets as a whole while

Google/Facebook and similar user event streams could be processed independently.

## Performance

Spreads library is optimized for performance and memory usage.

It is several times faster than other open source [projects](https://github.com/BlueMountainCapital/Deedle),

does not allocate memory for intermediate calculations or windows,

and provides real-time incremental calculations with low-latency lock-free synchronization

between data producers and consumers. You could run tests and [benchmarks](https://github.com/Spreads/Spreads/blob/master/tests/Spreads.Tests/Benchmarks.fs)

to see the exact numbers.

For regular keys - keys that have equal difference between them (e.g. seconds) - Spreads stores

only the first key and the step size, reducing memory usage for `` data item by

8 bytes. So `` data item takes only 8 bytes inside Spreads series instead of 16.

The gains of this optimization are not obvious on microbenchmarks with a single

series, and one could argue that memory is cheap. However, L1/L2/L3 caches

are still small, and saving 50% of memory allows to place two times

more useful data in the caches and to avoid needless cache trashing.

Spreads library is written in C# and F# and targets .NET 4.5.1 and .NET Standard 1.6 versions.

.NET gives native performance when optimized for memory access patterns, which means

no functional data structures and minimum allocations.

Even though .NET is a managed platform with garbage collection, in a steady state Spreads

should not allocate many objects and create GC pressure.

.NET properly supports generic value types and arrays of them are laid out

contiguously in memory. Such layout enables CPUs to prefetch data efficiently,

resulting in great performance boost compared to collections of boxed objects. Also .NET makes

it trivial to call native methods and *Spreads.Core* project

uses SIMD-optimized compression and math libraries written in C.

We haven't compared Spreads performance to performance of commercial systems yet

(because their costs are atrocious and learning cryptic languages is not necessary).

However, the main benchmark while developing Spreads was modern CPUs capabilities,

not any existing product. We tried to achieve mechanical sympathy, to avoid any wasteful

operations and to get the most from modern processors. Therefore, unless the fastest commercial

products use magic or quantum computers, Spreads must be in the same bracket.

## Series manipulation and join

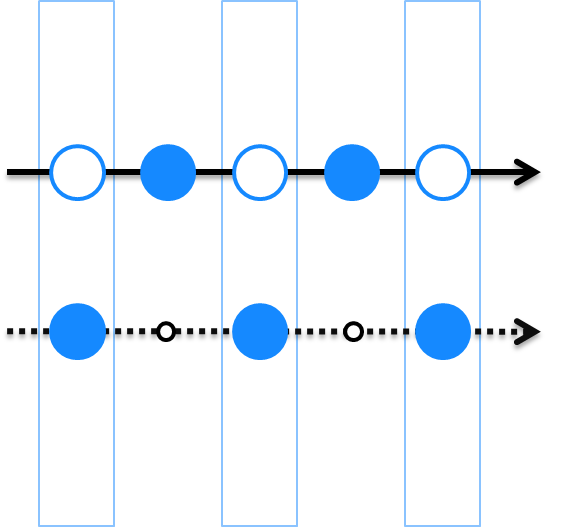

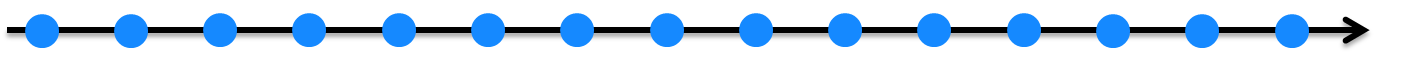

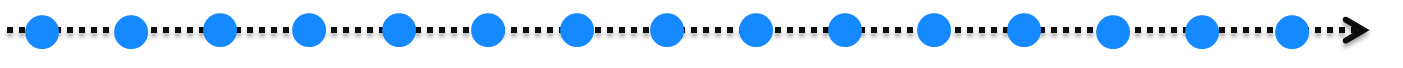

### Continuous and discrete series

Series could be continuous or discrete. Continuous series have values at any key,

even between observed keys. For example, linear interpolation or cubic splines are continuous series

defined from observed points. Another example is "last price", which is defined for any key as observed

price at or before the key.

Discrete series have values only at observations/events, e.g. trade volume

is meaningful only at observed trades, there is no implied latent volumes between trades. We could

create a derived continuous series, e.g. `let liquidity = volume.SMA(N).Repeat()`, but this

series changes meaning from a real observed volume to an abstract analytical indicator of average

liquidity over the last N observations.

On pictures, a solid line means continuous series, dotted line means discrete series, solid blue dot

means an observation, a white dot with blue outline means a calculated value of a continuous series

at a key between observations.

### Declarative lazy calculations

One of the core feature of Spreads library is declarative lazy series manipulation.

A calculation on series is not performed until results are pulled from Series. For example,

expression `let incremented = series + 1.0` is not evaluated until `incremented` series

is used. Instead, it returns a calculation definition that could be

evaluated on demand.

#### Missing values replacement

Missing values are really missing in Spreads, not represented as a special NA or option value.

When missing values are present as special values, one need to spend memory and CPU cycles to

process them (and a lot of brain cycles to comprehend why missing values are somehow present, and not

missing).

One of the most frequently used series transformations are `Repeat` and `Fill`. Calling them

on a discrete series returns a continuous series, where for each non-existing key we could get

a value from the key at or before requested key for `Repeat` or a given value for `Fill`:

let repeated = sparseSeries.Repeat()

let filled = sparseSeries.Fill(0.0)

The returned series contains infinite number of values defined for any key, but the values from

non-observed keys are calculated on demand and do not take any space.

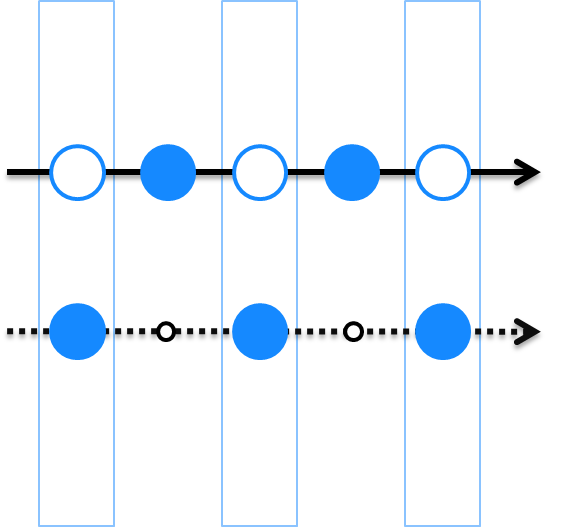

### ZipN

ZipN functionality is probably the most important part in Spreads.Core

and it is shown on Spreads logo.

ZipN supports declarative lazy joining of N series and in many

cases replaces Frames/Panels functionality and adds

real-time incremental calculations over N joined series.

All binary arithmetic operations are implemented via ZipN cursor with N=2.

ZipN alway produces inner join, but it is very easy to implement any complex

outer join by transforming an input series from a discrete to a continuous one.

For example, imagine we have two discrete series (in pseudocode) `let upper = [2=>2; 4=>4]`

and `let lower = [1=>10; 3=>30; 5=>50]` that correspond to the picture. If we add them via `+` operator,

we will get an empty series because there are no matching keys and inner join returns an empty set.

But if we repeat the upper series, we will get two items, because the

repeated upper series is defined at any key:

let sum = upper.Repeat() + lower // [3=>2+30=32; 5=>4+50=54]

If we then fill the lower series with 42, we will get:

let sum = upper.Repeat() + lower.Fill(42.0) // [2=>2+42=44; 3=>2+30=32; 4=>4+42=46; 5=>4+50=54]

For N series logic remains the same. If we want to calculate a simple price index like DJIA

for each tick of underlying stocks, we could take 30 tick series, repeat them (because ticks are irregular), apply `ZipN`

and calculate average of prices at any point:

let index30 : Series =

arrayOfDiscreteSeries

.Map(fun ds -> ds.Repeat())

.ZipN(fun (k:'DateTime) (vArr:'double[]) -> vArr.Average())

The values array `vArr` is not copied and the lambda must not return anything that has a

reference to the array. If the arrays of zipped values are needed for further use outside

zip method, one must copy the array inside the lambda. However, this is rarely needed,

because we could zip outputs of zips and process the arrays inside lambda without allocating

memory. For example, if we have series of returns and weights from applying Zip as before,

these series are not evaluated until values are requested, and when we zip them to calculate

SumProduct, we will only allocate two arrays of values and one array or arrays (pseudocode):

let returns = arrayOfPrices

.Map(fun p -> p.Repeat())

.ZipN(fun k (vArr:double[]) -> vArr)

.ZipLag(1,(fun (cur:double[]) (prev:double[]) -> cur.Zip(prev, (fun c p -> c/p - 1.0)))) // the last zip is on arrays, must be eager

let weights = arrayOfWeights

.Map(fun p -> p.Repeat())

.ZipN(fun k vArr -> vArr)

let indexReturn =

returns.ZipN(weights.Repeat(), (fun k (ret:double[]) (ws:double[]) -> SumProduct(ret, ws))

Here we violate the rule of not returning vArr, because it will be used inside lambda of

ZipLag, which applies lambda to current and lagged values and does not returns references to

them. But for this to be true, Zip of arrays must be eager and we will have to allocate

an array to store the result. We could change the example to avoid intermediate allocations:

let returns = arrayOfPrices

.Map(fun p -> p.Repeat())

.ZipN(fun k (vArr:double[]) -> vArr)

.ZipLag(1,(fun (cur:double[]) (prev:double[]) -> ValueTuple(cur,prev)))

let weights = arrayOfWeights

.Map(fun p -> p.Repeat())

.ZipN(fun k vArr -> vArr)

let indexReturn =

returns.ZipN(

weights.Repeat(),

(fun k (ret:ValueTuple) (ws:double[]) ->

let currentPrices : double[] = ret.Item1

let previousPrices: double[] = ret.Item2

let currentWeights: double[] = ws

// imperative for loop to walk over three arrays

// and calculate returns and sumproduct with weight

// we need a single value and could get it in many

// ways without copying the arrays

)

In the last ZipN lambda we have three arrays of current and previous prices and current weights.

We could calculate weighted return with them and return a single value. For each key, these arrays

are refilled with new values and the last lambda is reapplied to updated arrays.

When all series are continuous, we get full outer join and the resulting series will have

a union of all keys from input series, with values defined by continuous series constructor.

Other than repeat/fill it could be linear or spline interpolation, a forecast from

moving regression or any other complex logic that is hidden inside an input continuous

series. For outside world, such a continuous series becomes defined at every point, inner

join assumes that every key exists and zipping works as expected just as if we had precalculated

every point. But this works without allocating memory and also works in real-time for streaming

data.

## Install

PM> Install-Package Spreads

## Contributing

PRs & issues are welcome!

This Source Code Form is subject to the terms of the Mozilla Public

License, v. 2.0. If a copy of the MPL was not distributed with this

file, You can obtain one at http://mozilla.org/MPL/2.0/.

(c) Victor Baybekov, 2014-2017

## Status and version

Current status is alpha and we are actively working on [1.0-beta release](https://github.com/Spreads/Spreads/milestone/1). We will use [semantic versioning](http://semver.org/) after 1.0 release.

## Links

+ Twitter [@DataSpreads](https://twitter.com/DataSpreads)

+ [Introducing Spreads library](http://hotforknowledge.com/2015/12/20/introducing-spreads-library/) about why and how Spreads library was born.

+ [How to write the simplest trading strategy using Spreads](http://hotforknowledge.com/2015/12/29/how-to-write-the-simplest-trading-strategy-using-spreads/).

+ [Technical introduction with pictures: updated slides from Feb'16 London F# Meetup.](https://github.com/Spreads/Spreads.Docs/blob/master/docs/20160603_Spreads_technical_introduction.pdf)