https://github.com/10mohi6/portfolio-backtest-python

portfolio-backtest is a python library for backtest portfolio asset allocation on Python 3.7 and above.

https://github.com/10mohi6/portfolio-backtest-python

asset-allocation backtest cvar etf hrp minimum mutual-fund portfolio python stock tangency variance

Last synced: 10 months ago

JSON representation

portfolio-backtest is a python library for backtest portfolio asset allocation on Python 3.7 and above.

- Host: GitHub

- URL: https://github.com/10mohi6/portfolio-backtest-python

- Owner: 10mohi6

- Created: 2021-04-13T13:03:05.000Z (almost 5 years ago)

- Default Branch: main

- Last Pushed: 2021-04-21T02:39:24.000Z (almost 5 years ago)

- Last Synced: 2025-04-14T04:14:15.241Z (10 months ago)

- Topics: asset-allocation, backtest, cvar, etf, hrp, minimum, mutual-fund, portfolio, python, stock, tangency, variance

- Language: Python

- Homepage:

- Size: 1.1 MB

- Stars: 28

- Watchers: 1

- Forks: 3

- Open Issues: 1

-

Metadata Files:

- Readme: README.md

Awesome Lists containing this project

README

# portfolio-backtest

[](https://pypi.org/project/portfolio-backtest/)

[](https://opensource.org/licenses/MIT)

[](https://codecov.io/gh/10mohi6/portfolio-backtest-python)

[](https://travis-ci.com/10mohi6/portfolio-backtest-python)

[](https://pypi.org/project/portfolio-backtest/)

[](https://pepy.tech/project/portfolio-backtest)

portfolio-backtest is a python library for backtest portfolio asset allocation on Python 3.7 and above.

## Installation

$ pip install portfolio-backtest

$ pip install PyPortfolioOpt

## Usage

### basic run

```python

from portfolio_backtest import Backtest

Backtest(tickers=["VTI", "AGG", "GLD"]).run()

```

### advanced run

```python

from portfolio_backtest import Backtest

import pprint

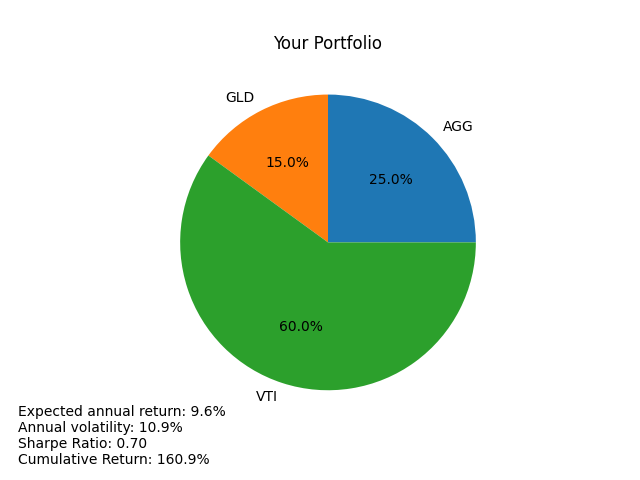

bt = Backtest(

tickers={

"VTI": 0.6,

"AGG": 0.25,

"GLD": 0.15,

},

target_return=0.1,

target_cvar=0.025,

data_dir="data",

start="2011-04-10",

end="2021-04-10",

)

pprint.pprint(bt.run(plot=True))

```

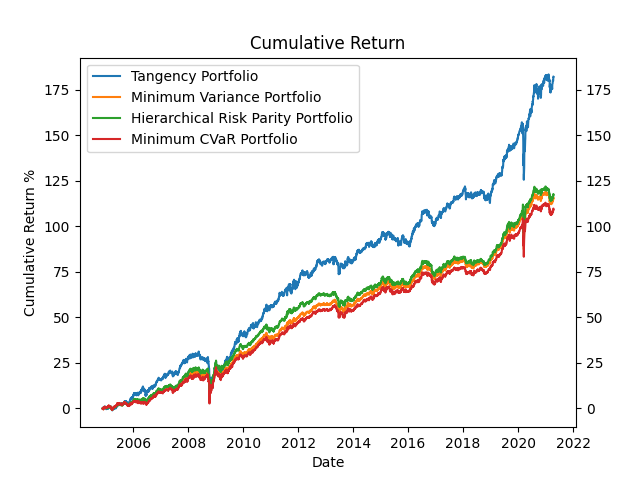

```python

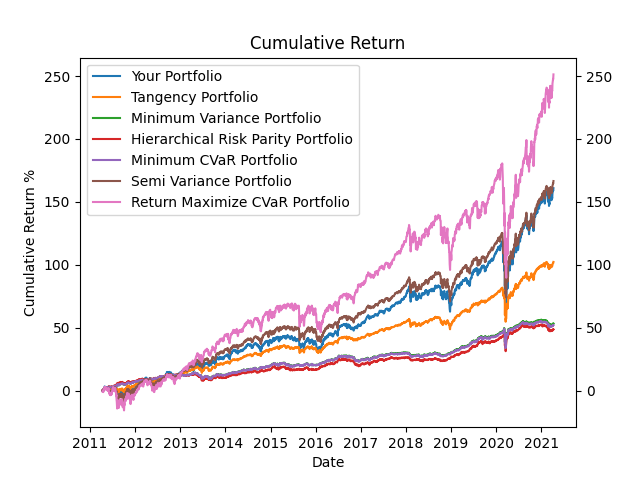

[{'Annual volatility': '10.9%',

'Conditional Value at Risk': '',

'Cumulative Return': '160.9%',

'Expected annual return': '9.6%',

'Sharpe Ratio': '0.70',

'portfolio': 'Your Portfolio',

'tickers': {'AGG': 0.25, 'GLD': 0.15, 'VTI': 0.6}},

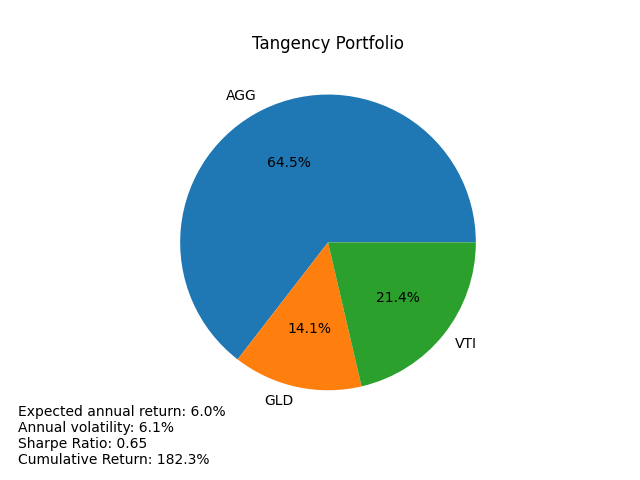

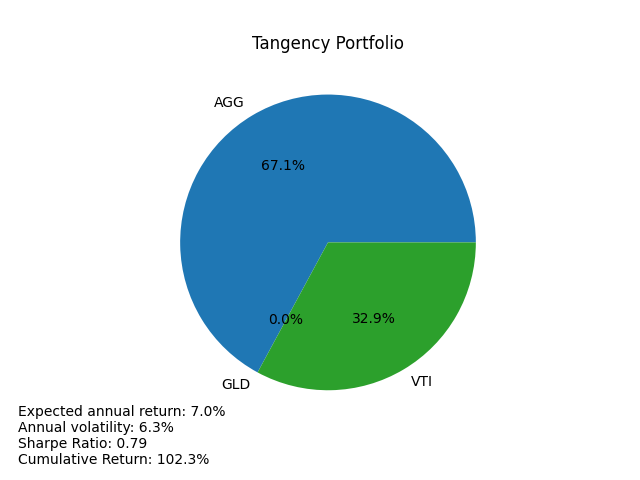

{'Annual volatility': '6.3%',

'Conditional Value at Risk': '',

'Cumulative Return': '102.3%',

'Expected annual return': '7.0%',

'Sharpe Ratio': '0.79',

'portfolio': 'Tangency Portfolio',

'tickers': {'AGG': 0.67099, 'GLD': 0.0, 'VTI': 0.32901}},

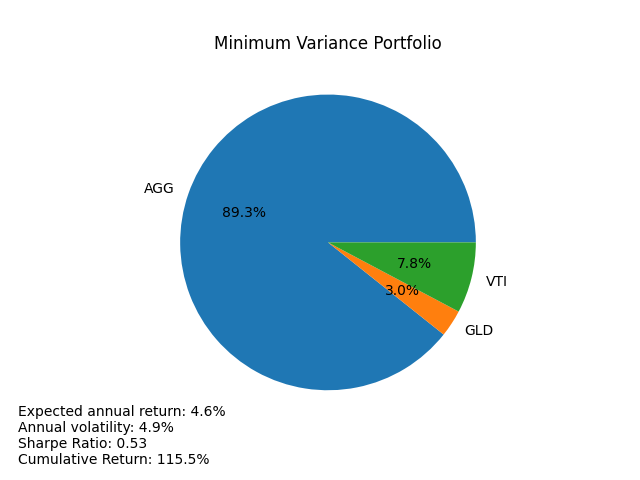

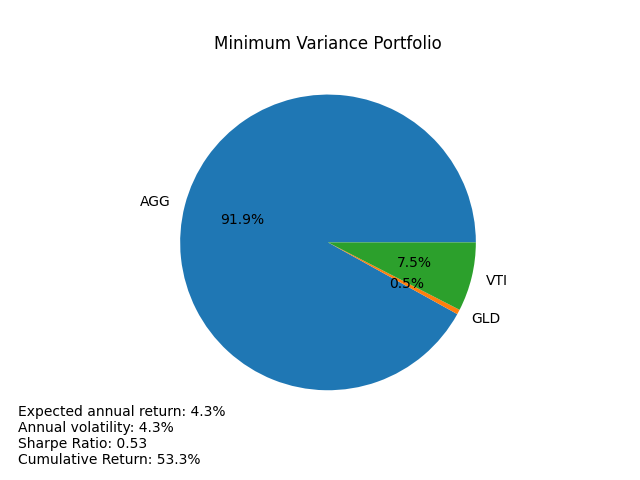

{'Annual volatility': '4.3%',

'Conditional Value at Risk': '',

'Cumulative Return': '53.3%',

'Expected annual return': '4.3%',

'Sharpe Ratio': '0.53',

'portfolio': 'Minimum Variance Portfolio',

'tickers': {'AGG': 0.91939, 'GLD': 0.00525, 'VTI': 0.07536}},

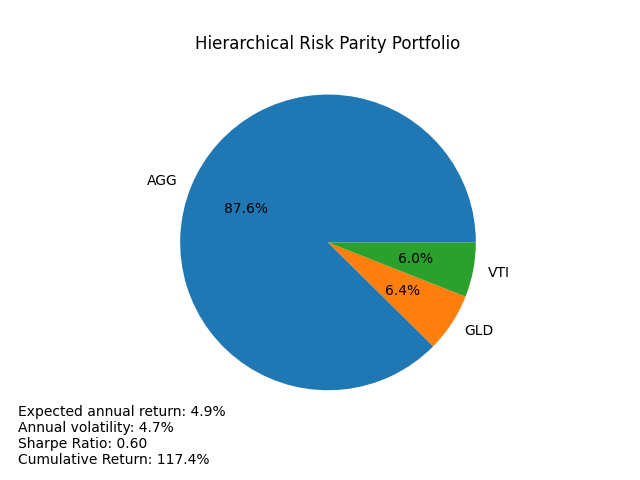

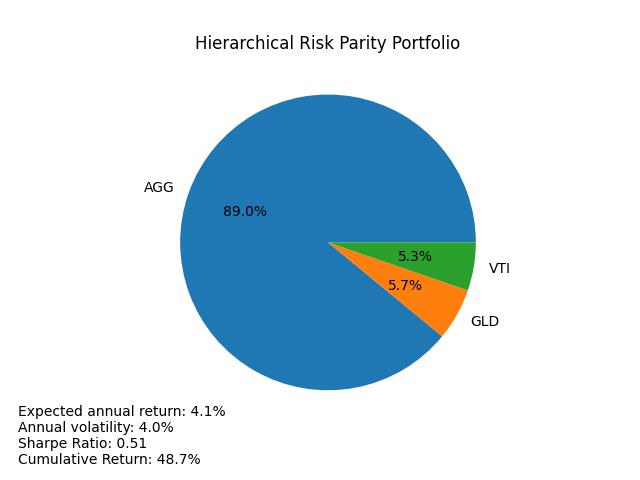

{'Annual volatility': '4.0%',

'Conditional Value at Risk': '',

'Cumulative Return': '48.7%',

'Expected annual return': '4.1%',

'Sharpe Ratio': '0.51',

'portfolio': 'Hierarchical Risk Parity Portfolio',

'tickers': {'AGG': 0.89041, 'GLD': 0.05695, 'VTI': 0.05263}},

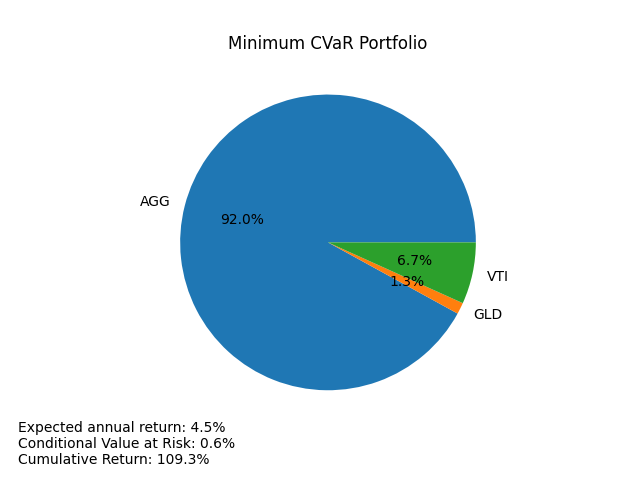

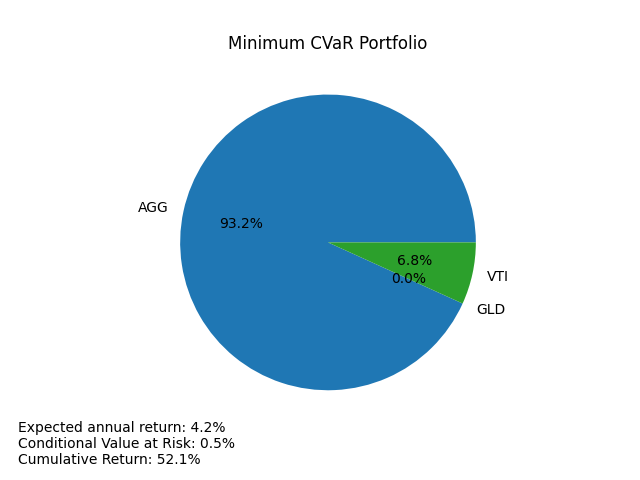

{'Annual volatility': '',

'Conditional Value at Risk': '0.5%',

'Cumulative Return': '52.1%',

'Expected annual return': '4.2%',

'Sharpe Ratio': '',

'portfolio': 'Minimum CVaR Portfolio',

'tickers': {'AGG': 0.93215, 'GLD': 0.0, 'VTI': 0.06785}},

{'Annual volatility': '7.7%',

'Conditional Value at Risk': '',

'Cumulative Return': '166.5%',

'Expected annual return': '10.0%',

'Sharpe Ratio': '1.04',

'portfolio': 'Semi Variance Portfolio (target return 10.0%)',

'tickers': {'AGG': 0.39504, 'GLD': 0.0, 'VTI': 0.60496}},

{'Annual volatility': '',

'Conditional Value at Risk': '2.5%',

'Cumulative Return': '251.3%',

'Expected annual return': '13.3%',

'Sharpe Ratio': '',

'portfolio': 'Return Maximize CVaR Portfolio (target CVaR 2.5%)',

'tickers': {'AGG': 0.08851, 'GLD': 0.0, 'VTI': 0.91149}}]

```

.png)

.png)

### Provides a method (discrete_allocation) that can be converted into an actual allocation available for purchase by entering the latest price and desired portfolio size ($ 10,000 in this example)

```python

from portfolio_backtest import Backtest

bt = Backtest(

tickers={

"VTI": 0.6,

"AGG": 0.25,

"GLD": 0.15,

}

)

print(bt.discrete_allocation(total_portfolio_value=10000))

```

```python

{'Discrete allocation': {'VTI': 28, 'AGG': 21, 'GLD': 9}, 'Funds remaining': '$109.45'}

```

## Supported Portfolio

- Your Portfolio

- Hierarchical Risk Parity Portfolio

- Tangency Portfolio

- Minimum Variance Portfolio

- Minimum CVaR Portfolio

- Semi Variance Portfolio

- Return Maximize CVaR Portfolio