Ecosyste.ms: Awesome

An open API service indexing awesome lists of open source software.

https://github.com/10mohi6/stock-backtest-python

stock-backtest is a python library for stock technical analysis backtest on Python 3.7 and above.

https://github.com/10mohi6/stock-backtest-python

backtest finance python stock technical-analysis trading trading-strategies

Last synced: 14 days ago

JSON representation

stock-backtest is a python library for stock technical analysis backtest on Python 3.7 and above.

- Host: GitHub

- URL: https://github.com/10mohi6/stock-backtest-python

- Owner: 10mohi6

- Created: 2021-05-08T13:47:16.000Z (over 3 years ago)

- Default Branch: main

- Last Pushed: 2021-05-11T06:27:21.000Z (over 3 years ago)

- Last Synced: 2025-01-09T10:44:42.492Z (26 days ago)

- Topics: backtest, finance, python, stock, technical-analysis, trading, trading-strategies

- Language: Python

- Homepage:

- Size: 65.4 KB

- Stars: 9

- Watchers: 1

- Forks: 3

- Open Issues: 0

-

Metadata Files:

- Readme: README.md

Awesome Lists containing this project

README

# stock-backtest

[](https://pypi.org/project/stock-backtest/)

[](https://opensource.org/licenses/MIT)

[](https://codecov.io/gh/10mohi6/stock-backtest-python)

[](https://travis-ci.com/10mohi6/stock-backtest-python)

[](https://pypi.org/project/stock-backtest/)

[](https://pepy.tech/project/stock-backtest)

stock-backtest is a python library for stock technical analysis backtest on Python 3.7 and above.

## Installation

$ pip install stock-backtest

## Usage

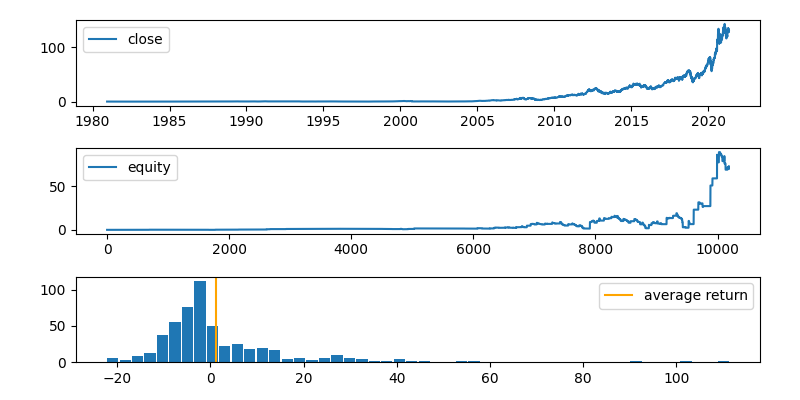

### basic run

```python

from stock_backtest import Backtest

class MyBacktest(Backtest):

def strategy(self):

fast_ma = self.sma(period=5)

slow_ma = self.sma(period=25)

# golden cross

self.sell_exit = self.buy_entry = (fast_ma > slow_ma) & (

fast_ma.shift() <= slow_ma.shift()

)

# dead cross

self.buy_exit = self.sell_entry = (fast_ma < slow_ma) & (

fast_ma.shift() >= slow_ma.shift()

)

MyBacktest("AAPL").run()

```

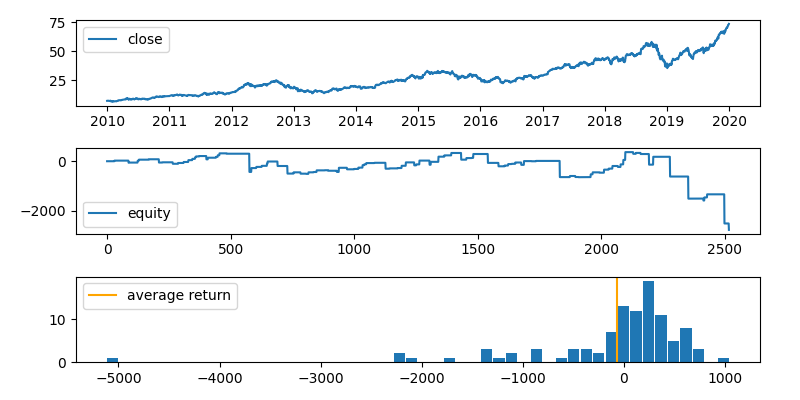

### advanced run

```python

from stock_backtest import Backtest

from pprint import pprint

class MyBacktest(Backtest):

def strategy(self):

rsi = self.rsi(period=10)

ema = self.ema(period=20)

atr = self.atr(period=20)

lower = ema - atr

upper = ema + atr

self.buy_entry = (rsi < 30) & (self.df.C < lower)

self.sell_entry = (rsi > 70) & (self.df.C > upper)

self.sell_exit = ema > self.df.C

self.buy_exit = ema < self.df.C

bt = MyBacktest(

"AAPL", # ticker

shares=100, # number of shares (default=1)

start="2010-01-01", # start date (default="")

end="2020-01-01", # end date (default="")

data_dir="data", # data directory (default=.)

)

pprint(bt.run(), sort_dicts=False)

```

```python

{'total profit': -2779.465,

'total trades': 102,

'win rate': 66.667,

'profit factor': 0.641,

'maximum drawdown': 3147.5,

'recovery factor': -0.883,

'riskreward ratio': 0.321,

'sharpe ratio': -0.085,

'average return': -68.929,

'stop loss': 0,

'take profit': 0}

```

## Supported indicators

- Simple Moving Average 'sma'

- Exponential Moving Average 'ema'

- Moving Average Convergence Divergence 'macd'

- Relative Strenght Index 'rsi'

- Bollinger Bands 'bbands'

- Stochastic Oscillator 'stoch'

- Average True Range 'atr'

## Strategy examples

### MACD

```python

class MyBacktest(Backtest):

def strategy(self):

macd, signal = self.macd(fast_period=12, slow_period=26, signal_period=9)

self.sell_exit = self.buy_entry = (macd > signal) & (

macd.shift() <= signal.shift()

)

self.buy_exit = self.sell_entry = (macd < signal) & (

macd.shift() >= signal.shift()

)

```

### Bollinger Bands

```python

class MyBacktest(Backtest):

def strategy(self):

upper, mid, lower = self.bbands(period=20, band=2)

self.sell_exit = self.buy_entry = (upper > self.df.C) & (

upper.shift() <= self.df.C.shift()

)

self.buy_exit = self.sell_entry = (lower < self.df.C) & (

lower.shift() >= self.df.C.shift()

)

```

### Stochastic

```python

class MyBacktest(Backtest):

def strategy(self):

k, d = self.stoch(k_period=5, d_period=3)

self.sell_exit = self.buy_entry = (

(k > 20) & (d > 20) & (k.shift() <= 20) & (d.shift() <= 20)

)

self.buy_exit = self.sell_entry = (

(k < 80) & (d < 80) & (k.shift() >= 80) & (d.shift() >= 80)

)

```

### Moving average divergence rate

```python

class MyBacktest(Backtest):

def strategy(self):

sma = self.sma(period=20)

ratio = (self.df.C - sma) / sma * 100

self.sell_exit = self.buy_entry = ratio > -5 & (ratio.shift() <= -5)

self.buy_exit = self.sell_entry = ratio < 5 & (ratio.shift() >= 5)

```

### Momentum

```python

class MyBacktest(Backtest):

def strategy(self):

mom = self.df.C - self.df.C.shift(10)

self.sell_exit = self.buy_entry = mom > 0 & (mom.shift() <= 0)

self.buy_exit = self.sell_entry = mom < 0 & (mom.shift() >= 0)

```

### Donchian Channels

```python

class MyBacktest(Backtest):

def strategy(self):

high = self.df.H.rolling(20).max()

low = self.df.L.rolling(20).min()

self.sell_exit = self.buy_entry = (high > self.df.C) & (

high.shift() <= self.df.C

)

self.buy_exit = self.sell_entry = (low < self.df.C) & (

low.shift() >= self.df.C

)

```

### Relative Vigor Index

```python

class MyBacktest(Backtest):

def rvi(

self, *, period: int = 10, price: str = "C"

) -> Tuple[pd.DataFrame, pd.DataFrame]:

co = self.df.C - self.df.O

n = (co + 2 * co.shift(1) + 2 * co.shift(2) + co.shift(3)) / 6

hl = self.df.H - self.df.L

d = (hl + 2 * hl.shift(1) + 2 * hl.shift(2) + hl.shift(3)) / 6

rvi = n.rolling(period).mean() / d.rolling(period).mean()

signal = (rvi + 2 * rvi.shift(1) + 2 * rvi.shift(2) + rvi.shift(3)) / 6

return rvi, signal

def strategy(self):

rvi, signal = self.rvi(period=5)

self.sell_exit = self.buy_entry = (rvi > signal) & (

rvi.shift() <= signal.shift()

)

self.buy_exit = self.sell_entry = (rvi < signal) & (

rvi.shift() >= signal.shift()

)

```