https://github.com/Anexen/pyxirr

Rust-powered collection of financial functions.

https://github.com/Anexen/pyxirr

day-count fast financial-analysis financial-functions isda maturin numpy pme private-equity pyo3 python python-extension rust xirr xirr-calculation xnpv

Last synced: 7 months ago

JSON representation

Rust-powered collection of financial functions.

- Host: GitHub

- URL: https://github.com/Anexen/pyxirr

- Owner: Anexen

- License: unlicense

- Created: 2021-05-04T20:23:25.000Z (over 4 years ago)

- Default Branch: main

- Last Pushed: 2025-01-02T18:16:10.000Z (9 months ago)

- Last Synced: 2025-03-17T00:15:16.569Z (7 months ago)

- Topics: day-count, fast, financial-analysis, financial-functions, isda, maturin, numpy, pme, private-equity, pyo3, python, python-extension, rust, xirr, xirr-calculation, xnpv

- Language: Rust

- Homepage: https://anexen.github.io/pyxirr/

- Size: 844 KB

- Stars: 188

- Watchers: 8

- Forks: 19

- Open Issues: 4

-

Metadata Files:

- Readme: README.md

- Changelog: CHANGELOG.md

- Funding: .github/FUNDING.yml

- License: LICENSE

Awesome Lists containing this project

README

[](https://www.rust-lang.org/)

[](https://github.com/Anexen/pyxirr/blob/master/LICENSE)

[](https://pypi.org/project/pyxirr/)

[](https://pypi.org/project/pyxirr/)

# PyXIRR

Rust-powered collection of financial functions.

PyXIRR stands for "Python XIRR" (for historical reasons), but contains many other financial functions such as IRR, FV, NPV, etc.

Features:

- correct

- supports different day count conventions (e.g. ACT/360, 30E/360, etc.)

- works with different input data types (iterators, numpy arrays, pandas DataFrames)

- no external dependencies

- type annotations

- blazingly fast

# Installation

```

pip install pyxirr

```

> WASM wheels for [pyodide](https://github.com/pyodide/pyodide) are also available,

> but unfortunately are [not supported by PyPI](https://github.com/pypi/warehouse/issues/10416).

> You can find them on the [GitHub Releases](https://github.com/Anexen/pyxirr/releases) page.

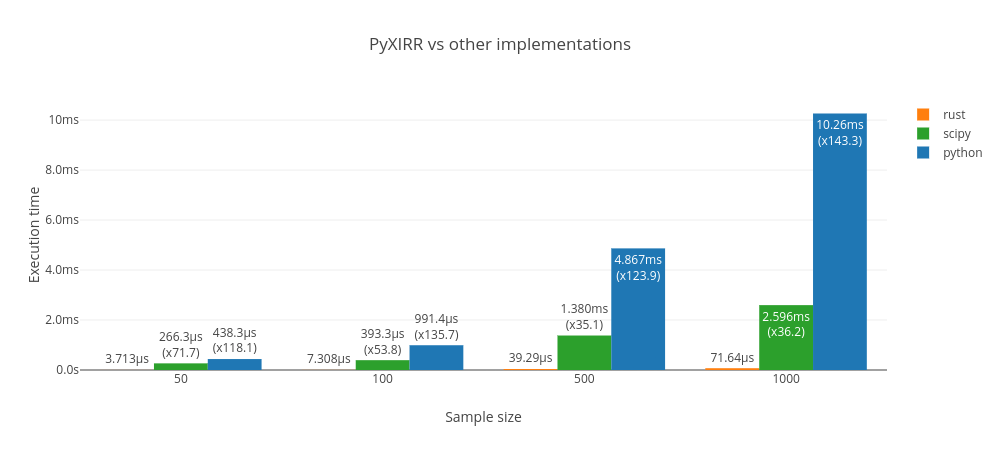

# Benchmarks

Rust implementation has been tested against existing [xirr](https://pypi.org/project/xirr/) package

(uses [scipy.optimize](https://docs.scipy.org/doc/scipy/reference/generated/scipy.optimize.newton.html) under the hood)

and the [implementation from the Stack Overflow](https://stackoverflow.com/a/11503492) (pure python).

PyXIRR is much faster than the other implementations.

Powered by [github-action-benchmark](https://github.com/benchmark-action/github-action-benchmark) and [plotly.js](https://github.com/plotly/plotly.js).

Live benchmarks are hosted on [Github Pages](https://anexen.github.io/pyxirr/bench).

# Example

```python

from datetime import date

from pyxirr import xirr

dates = [date(2020, 1, 1), date(2021, 1, 1), date(2022, 1, 1)]

amounts = [-1000, 750, 500]

# feed columnar data

xirr(dates, amounts)

# feed iterators

xirr(iter(dates), (x / 2 for x in amounts))

# feed an iterable of tuples

xirr(zip(dates, amounts))

# feed a dictionary

xirr(dict(zip(dates, amounts)))

# dates as strings

xirr(['2020-01-01', '2021-01-01'], [-1000, 1200])

```

# Multiple IRR problem

The Multiple IRR problem occurs when the signs of cash flows change more than

once. In this case, we say that the project has non-conventional cash flows.

This leads to situation, where it can have more the one IRR or have no IRR at all.

PyXIRR addresses the Multiple IRR problem as follows:

1. It looks for positive result around 0.1 (the same as Excel with the default guess=0.1).

2. If it can't find a result, it uses several other attempts and selects the lowest IRR to be conservative.

Here is an example illustrating how to identify multiple IRRs:

```python

import numpy as np

import pyxirr

# load cash flow:

cf = pd.read_csv("tests/samples/30-22.csv", names=["date", "amount"])

# check whether the cash flow is conventional:

print(pyxirr.is_conventional_cash_flow(cf["amount"])) # false

# build NPV profile:

# calculate 50 NPV values for different rates

rates = np.linspace(-0.5, 0.5, 50)

# any iterable, any rates, e.g.

# rates = [-0.5, -0.3, -0.1, 0.1, -0.6]

values = pyxirr.xnpv(rates, cf)

# print NPV profile:

# NPV changes sign two times:

# 1) between -0.316 and -0.295

# 2) between -0.03 and -0.01

print("NPV profile:")

for rate, value in zip(rates, values):

print(rate, value)

# plot NPV profile

import pandas as pd

series = pd.Series(values, index=rates)

pd.DataFrame(series[series > -1e6]).assign(zero=0).plot()

# find points where NPV function crosses zero

indexes = pyxirr.zero_crossing_points(values)

print("Zero crossing points:")

for idx in indexes:

print("between", rates[idx], "and", rates[idx+1])

# XIRR has two results:

# -0.31540826742734207

# -0.028668460065441048

for i, idx in enumerate(indexes, start=1):

rate = pyxirr.xirr(cf, guess=rates[idx])

npv = pyxirr.xnpv(rate, cf)

print(f"{i}) {rate}; XNPV = {npv}")

```

# More Examples

### Numpy and Pandas

```python

import numpy as np

import pandas as pd

# feed numpy array

xirr(np.array([dates, amounts]))

xirr(np.array(dates), np.array(amounts))

# feed DataFrame (columns names doesn't matter; ordering matters)

xirr(pd.DataFrame({"a": dates, "b": amounts}))

# feed Series with DatetimeIndex

xirr(pd.Series(amounts, index=pd.to_datetime(dates)))

# bonus: apply xirr to a DataFrame with DatetimeIndex:

df = pd.DataFrame(

index=pd.date_range("2021", "2022", freq="MS", inclusive="left"),

data={

"one": [-100] + [20] * 11,

"two": [-80] + [19] * 11,

},

)

df.apply(xirr) # Series(index=["one", "two"], data=[5.09623547168478, 8.780801977141174])

```

### Day count conventions

Check out the available options on the [docs/day-count-conventions](https://anexen.github.io/pyxirr/functions.html#day-count-conventions).

```python

from pyxirr import DayCount

xirr(dates, amounts, day_count=DayCount.ACT_360)

# parse day count from string

xirr(dates, amounts, day_count="30E/360")

```

### Private equity performance metrics

```python

from pyxirr import pe

pe.pme_plus([-20, 15, 0], index=[100, 115, 130], nav=20)

pe.direct_alpha([-20, 15, 0], index=[100, 115, 130], nav=20)

```

[Docs](https://anexen.github.io/pyxirr/private_equity.html)

### Other financial functions

```python

import pyxirr

# Future Value

pyxirr.fv(0.05/12, 10*12, -100, -100)

# Net Present Value

pyxirr.npv(0, [-40_000, 5_000, 8_000, 12_000, 30_000])

# IRR

pyxirr.irr([-100, 39, 59, 55, 20])

# ... and more! Check out the docs.

```

[Docs](https://anexen.github.io/pyxirr/functions.html)

### Vectorization

PyXIRR supports numpy-like vectorization.

If all input is scalar, returns a scalar float. If any input is array_like,

returns values for each input element. If multiple inputs are

array_like, performs broadcasting and returns values for each element.

```python

import pyxirr

# feed list

pyxirr.fv([0.05/12, 0.06/12], 10*12, -100, -100)

pyxirr.fv([0.05/12, 0.06/12], [10*12, 9*12], [-100, -200], -100)

# feed numpy array

import numpy as np

rates = np.array([0.05, 0.06, 0.07])/12

pyxirr.fv(rates, 10*12, -100, -100)

# feed any iterable!

pyxirr.fv(

np.linspace(0.01, 0.2, 10),

(x + 1 for x in range(10)),

range(-100, -1100, -100),

tuple(range(-100, -200, -10))

)

# 2d, 3d, 4d, and more!

rates = [[[[[[0.01], [0.02]]]]]]

pyxirr.fv(rates, 10*12, -100, -100)

```

# API reference

See the [docs](https://anexen.github.io/pyxirr)

# Roadmap

- [x] Implement all functions from [numpy-financial](https://numpy.org/numpy-financial/latest/index.html)

- [x] Improve docs, add more tests

- [x] Type hints

- [x] Vectorized versions of numpy-financial functions.

- [ ] Compile library for rust/javascript/python

# Development

Running tests with pyo3 is a bit tricky. In short, you need to compile your tests without `extension-module` feature to avoid linking errors.

See the following issues for the details: [#341](https://github.com/PyO3/pyo3/issues/341), [#771](https://github.com/PyO3/pyo3/issues/771).

If you are using `pyenv`, make sure you have the shared library installed (check for `${PYENV_ROOT}/versions//lib/libpython3.so` file).

```bash

$ PYTHON_CONFIGURE_OPTS="--enable-shared" pyenv install

```

Install dev-requirements

```bash

$ pip install -r dev-requirements.txt

```

### Building

```bash

$ maturin develop

```

### Testing

```bash

$ LD_LIBRARY_PATH=${PYENV_ROOT}/versions/3.10.8/lib cargo test

```

### Benchmarks

```bash

$ pip install -r bench-requirements.txt

$ LD_LIBRARY_PATH=${PYENV_ROOT}/versions/3.10.8/lib cargo +nightly bench

```

# Building and distribution

This library uses [maturin](https://github.com/PyO3/maturin) to build and distribute python wheels.

```bash

$ docker run --rm -v $(pwd):/io ghcr.io/pyo3/maturin build --release --manylinux 2010 --strip

$ maturin upload target/wheels/pyxirr-${version}*

```