https://github.com/Grademark/grademark

An API for backtesting trading strategies in JavaScript and TypeScript.

https://github.com/Grademark/grademark

algorithmic-trading backtesting backtesting-trading-strategies data-forge drawdown drawdown-chart equity-curve javascript plot-charts quantitative-trading trade trading trading-strategies trading-strategy trading-system typescript

Last synced: 17 days ago

JSON representation

An API for backtesting trading strategies in JavaScript and TypeScript.

- Host: GitHub

- URL: https://github.com/Grademark/grademark

- Owner: Grademark

- License: mit

- Created: 2018-10-20T08:57:40.000Z (over 6 years ago)

- Default Branch: master

- Last Pushed: 2023-03-02T10:48:46.000Z (about 2 years ago)

- Last Synced: 2024-09-19T09:48:34.531Z (7 months ago)

- Topics: algorithmic-trading, backtesting, backtesting-trading-strategies, data-forge, drawdown, drawdown-chart, equity-curve, javascript, plot-charts, quantitative-trading, trade, trading, trading-strategies, trading-strategy, trading-system, typescript

- Language: TypeScript

- Homepage: http://www.the-data-wrangler.com/

- Size: 456 KB

- Stars: 273

- Watchers: 14

- Forks: 33

- Open Issues: 13

-

Metadata Files:

- Readme: README.md

- Funding: .github/FUNDING.yml

- License: LICENSE

Awesome Lists containing this project

README

# Grademark

Toolkit for algo trading and backtesting in JavaScript and TypeScript.

This API builds on [Data-Forge](http://data-forge-js.com/) and is best used from [Data-Forge Notebook](http://www.data-forge-notebook.com/) (making it easy to plot charts and visualize).

Check out the [release notes](release-notes.md) to see updates and breaking changes.

[Click here to support my work](https://www.codecapers.com.au/about#support-my-work)

Please see what this looks like in [the Grademark first example](https://github.com/grademark/grademark-first-example) and the unit tests in this repo.

Love this? Please star this repo!

## First example

From the [Grademark first example](https://github.com/grademark/grademark-first-example) here's some example output. [Click to see the first example as a notebook.](https://grademark.github.io/grademark-first-example/)

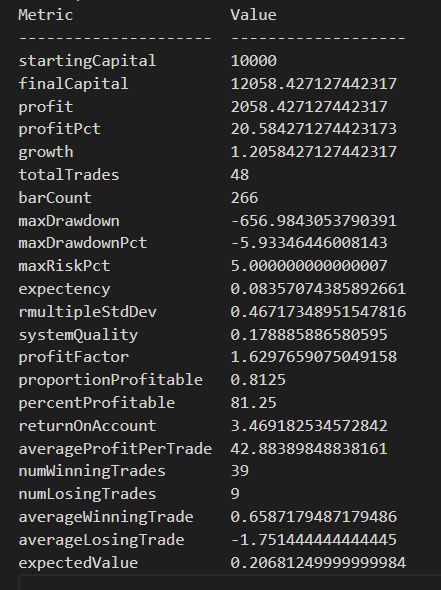

Analysis of a sequence of trades looks like this:

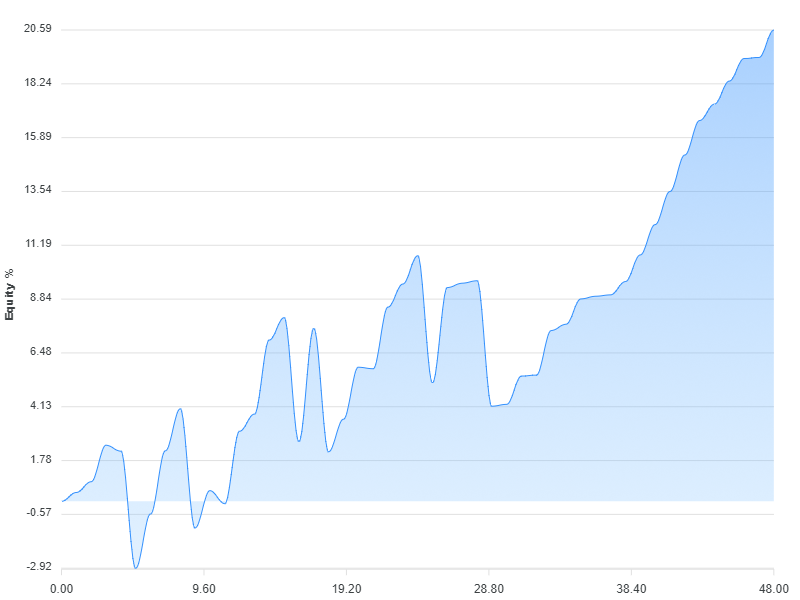

Here's a chart that visualizes the equity curve for the example strategy:

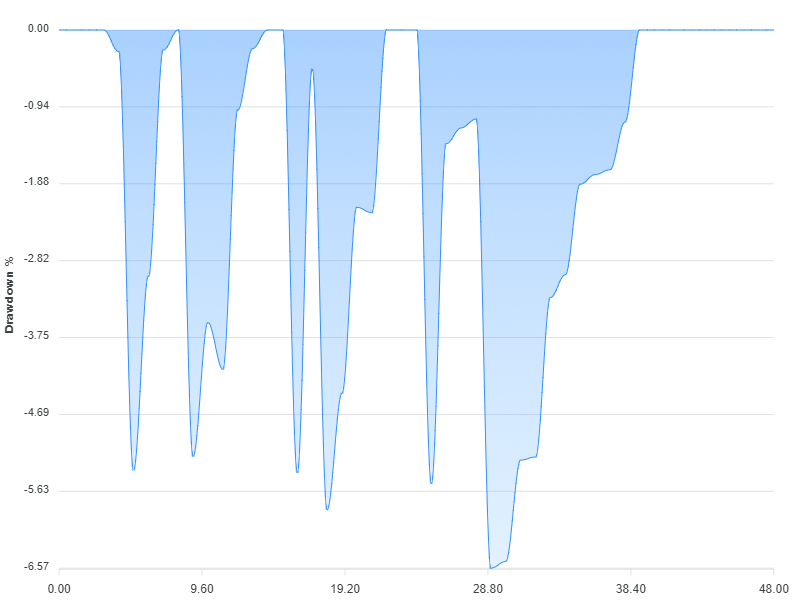

Here's another chart, this one is a visualization of the drawdown for the example strategy:

## Pre-requisites

- Make sure your data is sorted in forward chronological order.

## Data format

Your data needs to be loaded into memory in the following format:

```typescript

interface IBar {

time: Date;

open: number;

high: number;

low: number;

close: number;

}

const data: IBar[] = ... load your data ...

```

## Features

- Define a trading strategy with entry and exit rules.

- Backtest a trading strategy on a single financial instrument.

- Apply custom indicators to your input data series.

- Specify lookback period.

- Built-in intrabar stop loss.

- Compute and plot equity curve and drawdown charts.

- Throughly covered by automated tests.

- Calculation of risk and rmultiples.

- Intrabar profit target.

- Intrabar trailing stop loss.

- Conditional buy on price level (intrabar).

- Monte carlo simulation.

- Multiple parameter optimization based on permutations of parameters (using grid search and hill-climb algorithms).

- Walk forward optimization and backtesting.

- Plot a chart of trailing stop loss.

- Short selling.

[Data-Forge Notebook](https://www.data-forge-notebook.com/) comes with example JavaScript notebooks that demonstrate many of these features.

If you need help with new features please reach out!

## Maybe coming later

- Support for precise decimal numbers.

- Fees.

- Slippage.

- Position sizing.

- Testing multiple instruments / portfolio simulation / ranking instruments.

- Market filters.

## Complete examples

For a ready to go example please see the repo [grademark-first-example](https://github.com/grademark/grademark-first-example).

## Usage

Instructions here are for JavaScript, but this library is written in TypeScript and so it can also be used from TypeScript.

### Installation

npm install --save grademark

### Import modules

```javascript

const dataForge = require('data-forge');

require('data-forge-fs'); // For file loading capability.

require('data-forge-indicators'); // For the moving average indicator.

require('data-forge-plot'); // For rendering charts.

const { backtest, analyze, computeEquityCurve, computeDrawdown } = require('grademark');

```

### Load your data

Use [Data-Forge](http://data-forge-js.com/) to load and prep your data, make sure your data is sorted in forward chronological order.

This example loads a CSV file, but feel free to load your data from REST API, database or wherever you want!

```javascript

let inputSeries = dataForge.readFileSync("STW.csv")

.parseCSV()

.parseDates("date", "D/MM/YYYY")

.parseFloats(["open", "high", "low", "close", "volume"])

.setIndex("date") // Index so we can later merge on date.

.renameSeries({ date: "time" });

```

The example data file is available in [the example repo](https://github.com/grademark/grademark-first-example).

### Add indicators

Add whatever indicators and signals you want to your data.

```javascript

const movingAverage = inputSeries

.deflate(bar => bar.close) // Extract closing price series.

.sma(30); // 30 day moving average.

inputSeries = inputSeries

.withSeries("sma", movingAverage) // Integrate moving average into data, indexed on date.

.skip(30) // Skip blank sma entries.

```

### Create a strategy

This is a very simple and very naive mean reversion strategy:

```javascript

const strategy = {

entryRule: (enterPosition, args) => {

if (args.bar.close < args.bar.sma) { // Buy when price is below average.

enterPosition({ direction: "long" }); // Long is default, pass in "short" to short sell.

}

},

exitRule: (exitPosition, args) => {

if (args.bar.close > args.bar.sma) {

exitPosition(); // Sell when price is above average.

}

},

stopLoss: args => { // Optional intrabar stop loss.

return args.entryPrice * (5/100); // Stop out on 5% loss from entry price.

},

};

```

### Running a backtest

Backtest your strategy, then compute and print metrics:

```javascript

const trades = backtest(strategy, inputSeries)

console.log("Made " + trades.length + " trades!");

const startingCapital = 10000;

const analysis = analyze(startingCapital, trades);

console.log(analysis);

```

### Visualizing the results

Use [Data-Forge Plot](https://github.com/data-forge/data-forge-plot) to visualize the equity curve and drawdown chart from your trading strategy:

```javascript

computeEquityCurve(trades)

.plot()

.renderImage("output/my-equity-curve.png");

computeDrawdown(trades)

.plot()

.renderImage("output/my-drawdown.png");

```

## Advanced backtesting

We are only just getting started in this example to learn more please follow my [blog](http://www.the-data-wrangler.com/) and [YouTube channel](https://www.youtube.com/channel/UCOxw0jy384_wFRwspgq7qMQ).

## Resources

- [Data-Forge](http://data-forge-js.com/)

- [Data-Forge Notebook](http://www.data-forge-notebook.com/)

## Support the developer