https://github.com/izikeros/trend_classifier

Library for automated signal segmentation, trend classification and analysis.

https://github.com/izikeros/trend_classifier

algorithmic-trading algotrading timeseries-segmentation trading-bot trend-analysis trend-detection

Last synced: 15 days ago

JSON representation

Library for automated signal segmentation, trend classification and analysis.

- Host: GitHub

- URL: https://github.com/izikeros/trend_classifier

- Owner: izikeros

- License: mit

- Created: 2022-08-30T14:57:00.000Z (almost 3 years ago)

- Default Branch: main

- Last Pushed: 2024-07-19T12:12:04.000Z (12 months ago)

- Last Synced: 2024-11-26T10:45:27.159Z (8 months ago)

- Topics: algorithmic-trading, algotrading, timeseries-segmentation, trading-bot, trend-analysis, trend-detection

- Language: Python

- Homepage:

- Size: 740 KB

- Stars: 28

- Watchers: 1

- Forks: 9

- Open Issues: 3

-

Metadata Files:

- Readme: README.md

- Changelog: CHANGELOG.md

- License: LICENSE

Awesome Lists containing this project

README

# Trend classifier

[](https://results.pre-commit.ci/latest/github/izikeros/trend_classifier/main)

[](https://github.com/izikeros/trend_classifier/actions/workflows/black.yml)

[](https://github.com/izikeros/trend_classifier/actions/workflows/flake8.yml)

[](https://github.com/izikeros/trend_classifier/actions/workflows/pytest.yml)

[](https://codeclimate.com/github/izikeros/trend_classifier/maintainability)

[](https://codecov.io/gh/izikeros/trend_classifier)

Library for automated signal segmentation, trend classification and analysis.

## Installation

1. The package is pip-installable. To install it, run:

```sh

pip3 install trend-classifier

```

## Usage

### Pandas DataFrame Input

usage:

```python

import yfinance as yf

from trend_classifier import Segmenter

# download data from yahoo finance

df = yf.download("AAPL", start="2018-09-15", end="2022-09-05", interval="1d", progress=False)

x_in = list(range(0, len(df.index.tolist()), 1))

y_in = df["Adj Close"].tolist()

seg = Segmenter(x_in, y_in, n=20)

seg.calculate_segments()

```

For graphical output use `Segmenter.plot_segments()`:

```python

seg.plot_segments()

```

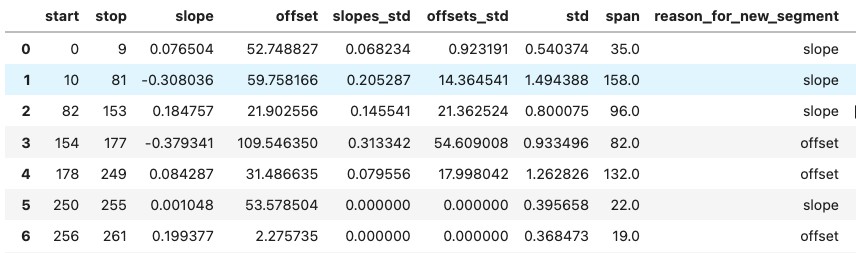

After calling method `Segmenter.calculate_segments()` segments are identified and information is stored in `Segmenter.segments` as list of Segment objects. Each Segment object. Each Segment object has attributes such as 'start', 'stop' - range of indices for the extracted segment, slope and many more attributes that might be helpful for further analysis.

Exemplary info on one segment:

```python

from devtools import debug

debug(seg.segments[3])

```

and you should see something like this:

```

seg.segments[3]: Segment(

start=154,

stop=177,

slope=-0.37934038908585044,

offset=109.54630934894907,

slopes=[

-0.45173184100846725,

-0.22564684358754555,

0.15555037018051593,

0.34801127785130714,

],

offsets=[

121.65628807526804,

83.56079272220015,

17.32660986821478,

-17.86417581658647,

],

slopes_std=0.31334199799377654,

offsets_std=54.60900279722876,

std=0.933497081795997,

span=82.0,

reason_for_new_segment='offset',

)

```

export results to tabular format (pandas DataFrame):

```python

seg.segments.to_dataframe()

```

(**NOTE:** for clarity reasons, not all columns are shown in the screenshot above)

## Alternative approach

- Smooth out the price data using the Savitzky-Golay filter,

- label the highs and lows.

- higher highs and higher lows indicates an uptrend.

The requirement here is than you need OHLC data for the assets you would like to analyse.

## License

[MIT](LICENSE) © [Krystian Safjan](https://safjan.com/).