Ecosyste.ms: Awesome

An open API service indexing awesome lists of open source software.

https://github.com/moindalvs/a_guide_for_actuarial_science

What is Actuarial analyst ? what are their responsibilities, skills required and interview questions

https://github.com/moindalvs/a_guide_for_actuarial_science

Last synced: about 11 hours ago

JSON representation

What is Actuarial analyst ? what are their responsibilities, skills required and interview questions

- Host: GitHub

- URL: https://github.com/moindalvs/a_guide_for_actuarial_science

- Owner: MoinDalvs

- Created: 2022-11-03T14:06:41.000Z (about 2 years ago)

- Default Branch: main

- Last Pushed: 2023-02-24T13:46:01.000Z (over 1 year ago)

- Last Synced: 2023-03-08T12:08:12.812Z (over 1 year ago)

- Size: 539 KB

- Stars: 3

- Watchers: 1

- Forks: 0

- Open Issues: 0

-

Metadata Files:

- Readme: README.md

Awesome Lists containing this project

README

## 0.1 Table of Contents

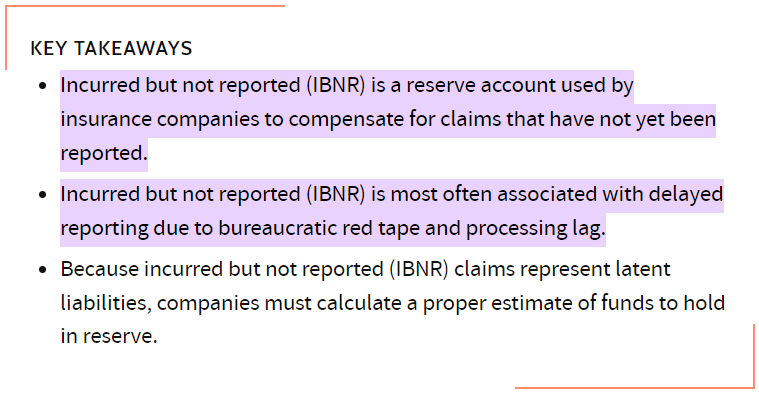

1. [Actuarial Analyst](#1)

- 1.1 [Why work as an analyst?](#1.1)

- 1.2 [What does an Actuarial analysts do?](#1.2)

- 1.3 [How do I become an actuarial analyst?](#1.3)

- 1.4 [Job Responsibilities are the Main Difference](#1.4)

- 1.5 [Is the actuarial analyst career right for you?](#1.5)

- 1.6 [12 Types Of Actuaries And Their Role Description](#1.6)

2. [Actuarial science](#2)

3. [What is Risk?](#3)

- 3.1 [Types of Risks](#3.1)

- 3.2 [What Is Financial Risk?](#3.2)

4. [What is Insurance?](#4)

- 4.1 [Principles of Insurance](#4.1)

- 4.2 [Average Deviation](#4.2)

- 4.3 [What Is Liability Insurance?](#4.3)

- 4.4 [Characteristics of an Ideally Insurable Risk](#4.4)

5. [What Is the Morbidity Rate?](#5)

6. [What Is the Law of Large Numbers?](#6)

7. [Insurance obligation](#7)

8. [What Is Reinsurance?](#8)

- 8.1 [How Reinsurance Works](#8.1)

9. [Deductibles](#9)

10. [What Is Coinsurance?](#10)

11. [What Are Copays?](#11)

12. [Coinsurance vs. Copay: What's the Difference?](#12)

13. [Co-pay vs. Deductible: What’s the Difference?](#13)

14. [What Are Out-of-Pocket Maximums?](#14)

15. [What’s a High-Deductible Health Plan?](#15)

16. [In-Network vs. Out-of-Network](#16)

17. [In-Patient vs Out-Patient](#17)

18. [Stop-Loss Insurance 101](#18)

- 18.1 [There are two types of self-funded insurance:](#18.1)

19. [What is lasering?](#19)

20. [Definition of Technical Provisions](#20)

21. [Health Reimbursement Arrangement (HRA)?](#21)

22. [Health Savings Account (HSA)](#22)

23. [Prefered Provider Organization (PPO)](#23)

24. [Health Maintenance Organization (HMO)](#24)

25. [Point-of-Service (POS)](#25)

26. [What Is Incurred But Not Reported (IBNR)?](#26)

27. [Wholesale and Retail Insurance?](#27)

28. [Actuarial Common Interview Questions](#28)

# 1.) Actuarial Analyst

**Actuarial analysts provide pivotal financial information to financial institutions, insurance companies, and other businesses. They predominantly analyze data using statistical modeling and complex mathematical formulas to assess risk. Actuarial analysts report to credentialed actuaries.**

**Actuarial science is a deeply sought-after field that plays a high role in the success of a company. Actuarial analysts help accredited actuaries make strategic decisions and communicate solutions for deeply complex financial issues.**

**Many types of companies find value in hiring actuarial analysts. Some of the most common employers of actuarial analysts are insurance companies, consulting firms, government, hospitals, banks, and investment firms. There is typically a divide between those in life disciplines (life and health insurance) and those in non-life disciplines (auto, home, and property insurance).**

**The day-to-day role of an actuarial analyst involves quite a bit of mathematical work and analysis. It’s a fairly competitive field, meaning that commitment and strong collegiate performance can give you a leg up when searching for a job.**

## If you’re looking for a professional career that involves solving problems, working with tons of numbers, and analysing data, well, then becoming an actuarial analyst may just be the job for you!

### Learn about the key requirements, duties, responsibilities, and skills that should be in an actuarial analyst job description.

### What is an actuarial analyst?

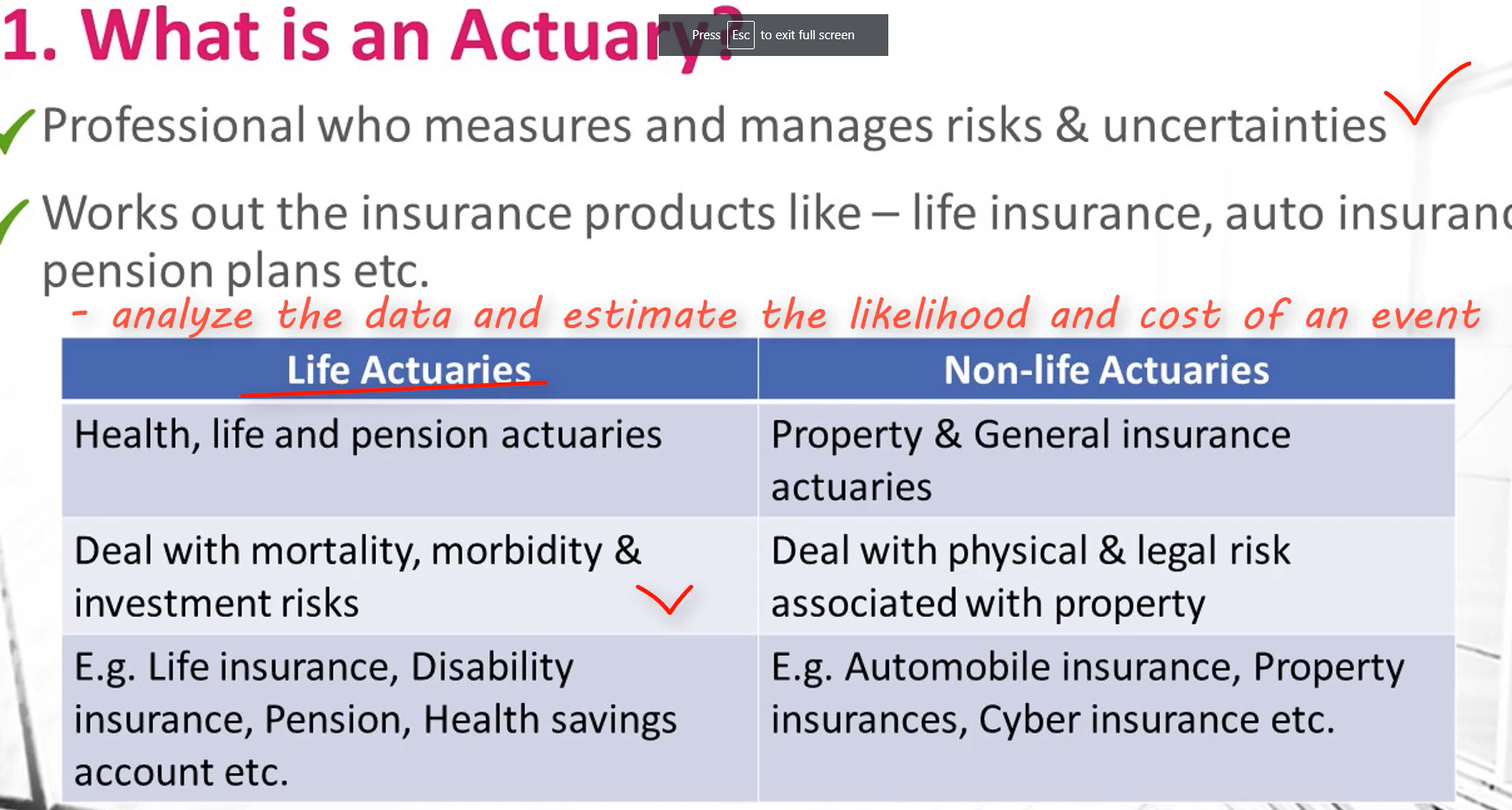

Before we talk about what an actuarial analyst is, it’s important that you first understand what an actuary is. Because, an actuarial analyst is just the job title of someone that is working in a role as an actuary, but isn’t yet a fully qualified actuary.

#### Actuary Job Details

An actuary is someone that quantifies risk. They use statistics, probabilities, and financial concepts in order put a financial dollar value on an event that may or may not occur in the future.

They typically work in insurance companies determining how much to charge for insurance policies, or figuring out how much money an insurance company needs to save in order to keep their commitments to policyholders.

The key thing to understand here is that becoming a fully qualified actuary takes many years. Usually between 7-10 years actually. But anyone that is in the process of becoming an actuary can still work in the actuarial field (as an actuarial analyst) before they’re fully qualified.

#### 1.1 ) Why work as an analyst?

This allows them to gain valuable work experience and industry knowledge well before they’re fully qualified. That’s important because fully qualified actuaries have a huge amount of responsibility and their job requires lots of professional judgement that can only be attained through years of experience.

So, sometimes the job title of an actuary that isn’t yet fully qualified is “actuarial analyst”. But this is just a job title. Another common job title (which means the exact same thing) is “actuarial associate”.

In some cases, the job title may just be “actuary”, “pricing actuary”, “valuation actuary” or something else along those lines. The job titles often vary from company to company.

#### 1.2 ) What does an Actuarial analysts do?

Actuarial analysts use statistical models to analyze data and assess risk. Many industries employ actuarial analysts, but the insurance industry particularly uses their knowledge and skills to design and price insurance policies.

It’s most common for an actuarial analyst to be heavily involved in either the calculation of insurance premiums or reserves. Reserves are the industry term for the amount of assets (bonds, stocks, mortgages, private placements, etc.) that an insurance company needs to own in order to ensure that they are financially stable.

Since insurance contracts can last 50+ years, it’s important that insurance companies properly manage their cash flows to ensure they have enough money to pay any insurance claims that are made in the future. That’s why reserves are so important.

An actuarial analyst isn’t a fully qualified actuary and is still gaining knowledge and expertise in their industry. Because of this, they often do much of the technical work required in order for their immediate manager (usually a fully qualified actuary) and upper management to make informed decisions.

By doing much of the technical work, an actuarial analyst is able to dig deep into the details and fully understand how actuarial processes work, how reported values are calculated, and they’ll often investigate inconsistencies in data.

Having this in-depth insight into the business workings allows the actuarial analyst to develop in their career and become prepared for the requirements of a fully-qualified actuary.

#### 1.3 ) How do I become an actuarial analyst?

There are two primary requirements that are necessary in order to be an actuarial analyst. First, you need to get a Bachelor’s degree, and second you need to pass at least 1 actuarial exam.

### Bachelor’s Degree

Due to the nature of an actuarial analyst position, you need to be well-versed in topics such as finance, business, statistics and economics.

As a result, the first thing you’d need to do in order to become one is get a Bachelor’s degree. It doesn’t have to be a degree in one of the fields listed above, but it would be helpful in your career if it was. Actually, a degree technically isn’t required, but nearly all good candidates have one and an actuarial employer would be unlikely to hire someone without one.

Another option is to get your Bachelor’s degree in “actuarial science”. These courses are only offered in certain colleges and universities. They teach math concepts that are very specific to the actuarial field.

## 1.4 ) Job Responsibilities are the Main Difference

Aside from those requirements and the salary, there is a big difference in the job responsibilities of an actuarial analyst and a fully qualified actuary.

### The Actuary

A fully-qualified actuary will often be using their knowledge and expertise in order to make critical business decisions. They’ll rely extensively on their past experiences in the industry, as well as concepts learned by studying for the later actuarial exams.

They’ll often use data summaries, industry reports, and company objectives in order to make decisions that are best for the company overall. To do this, an actuary will regularly collaborate with other actuaries in the company in order to get different perspectives, discover potential drawbacks and ideas.

Combining expertise in this way can be very powerful and reduces the possibility of overlooking potential issues that may arise in the future.

### The Actuarial Analyst

On the other hand, an actuarial analyst often isn’t involved in as many of these high-level, decision-making collaborations. Instead, the analyst is typically responsible for collecting, analysing and summarizing all the data that is needed for the fully-qualified actuaries to make their decisions.

The actuaries need to take into consideration many different factors when making decisions, and quite often it requires large amounts of data to be summarized into numbers that can easily be interpreted. This is where the analyst comes in.

The analyst will put everything together for the actuaries that they report to. This gives the actuaries more time for higher-level thinking and decision making rather than being caught up in the weeds of all the data.

Analysts are often also responsible for the monthly, quarterly, and annual reporting processes that need to be completed by the actuarial departments. These are often fairly manual processes that require the analyst to fully understand the data, calculations and results.

Although analysts may not attend all the collaboration meetings, their inputs and perspectives are still very valuable. Oftentimes the actuary that they’re providing data to doesn’t know all the nuances of the data, calculations and results that are produced.

So, an analyst can make them aware of any potential problems that may arise in the actual implementation of business changes and decisions.

As may be expected, the job responsibilities of an actuarial analyst are much more technical than those of an actuary. But both are needed in order to allow the insurance company to function.

### Actuarial Analyst vs Actuarial Assistant. Are they the same?

An actuarial analyst and an actuarial assistant are not the same job. An actuarial analyst does most of the technical work involving gathering, analysing, and interpreting data whereas an actuarial assistant often works alongside a team of actuarial analysts. The assistant will help do the tasks that need to be done but don’t require the expertise and skill set of the analysts.

In order to do their job, and actuarial analyst often needs to know how to write code to automate tasks. They also spend time formatting reports, cleaning data, and entering data into the computer.

But, these tasks aren’t really utilizing the specialized knowledge and analytical abilities of the analyst. So, it makes sense to have someone else do these tasks rather than the analyst. The analyst can then spend more time on understanding and interpreting results.

Having an actuarial assistant also makes sense from a financial standpoint because they don’t need to be paid as high of a salary as an actuarial analyst would.

Having actuarial assistants is a company choice. Some companies have them, and others don’t. But for someone looking to get into an actuarial analyst position, an actuarial assistant job can be very beneficial in making connections and learning about actuarial work.

## 1.5 ) Is the actuarial analyst career right for you?

Most people don’t go into the actuarial profession without the intention to become a fully qualified actuary. The actuarial analyst job is a stepping stone on that journey. So, really, you have to think about whether a career as an actuary is right for you.

If you decide to stop pursuing a career as an actuary and stay as an actuarial analyst, you’ll be limited in your career growth opportunities and it may be difficult to switch companies (to another actuarial analyst position). Your exam process and work ethic will play a big part in whether this is possible.

#### You need to be goal oriented and persistent.

Getting through all the actuarial exams can be quite a long and difficult process. You need to be able to persevere through failures, and enjoy the challenge that each exam brings.

If you’re goal oriented, you’ll strive to complete the exams quickly, and the reward of a raise will motivate you.

#### Love problem solving.

Actuarial work regularly involves figuring out solutions to problems and a lot of judgement. Typically there’s no right or wrong answer in this field so it’s an analyst’s job to determine creative solutions and assess the advantages and disadvantages of each.

#### Enjoy math and working with numbers (a lot).

Actuaries work with numbers every single day. Most of them love to dig into the details and figure out why trends are occurring. Actuaries use numbers and mathematical concepts in order to make business decisions that are in the best interest of the company and its policyholders.

**`If you’re not good at math or don’t enjoy it, a career as an actuary likely won’t interest you for very long.`**

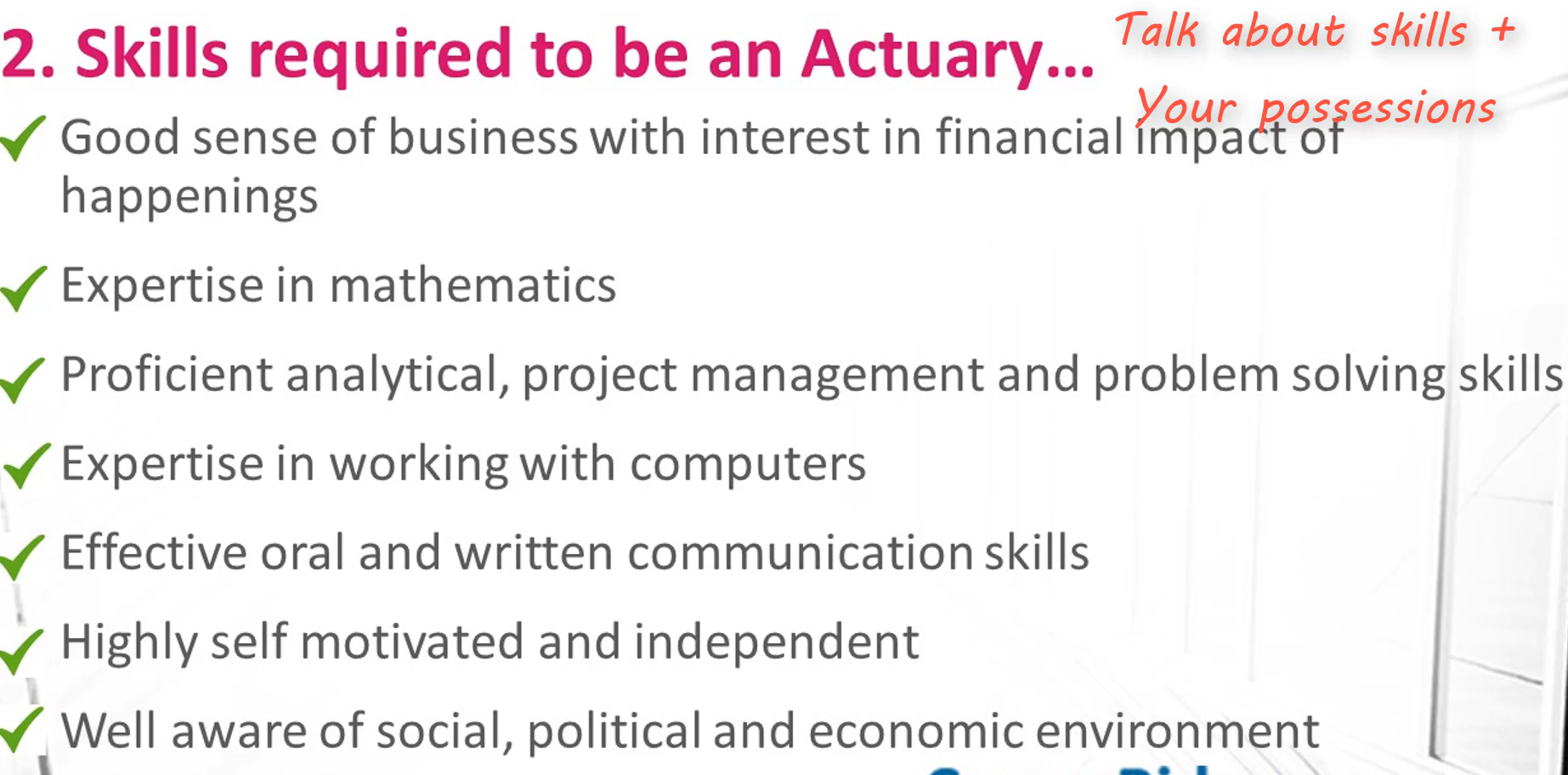

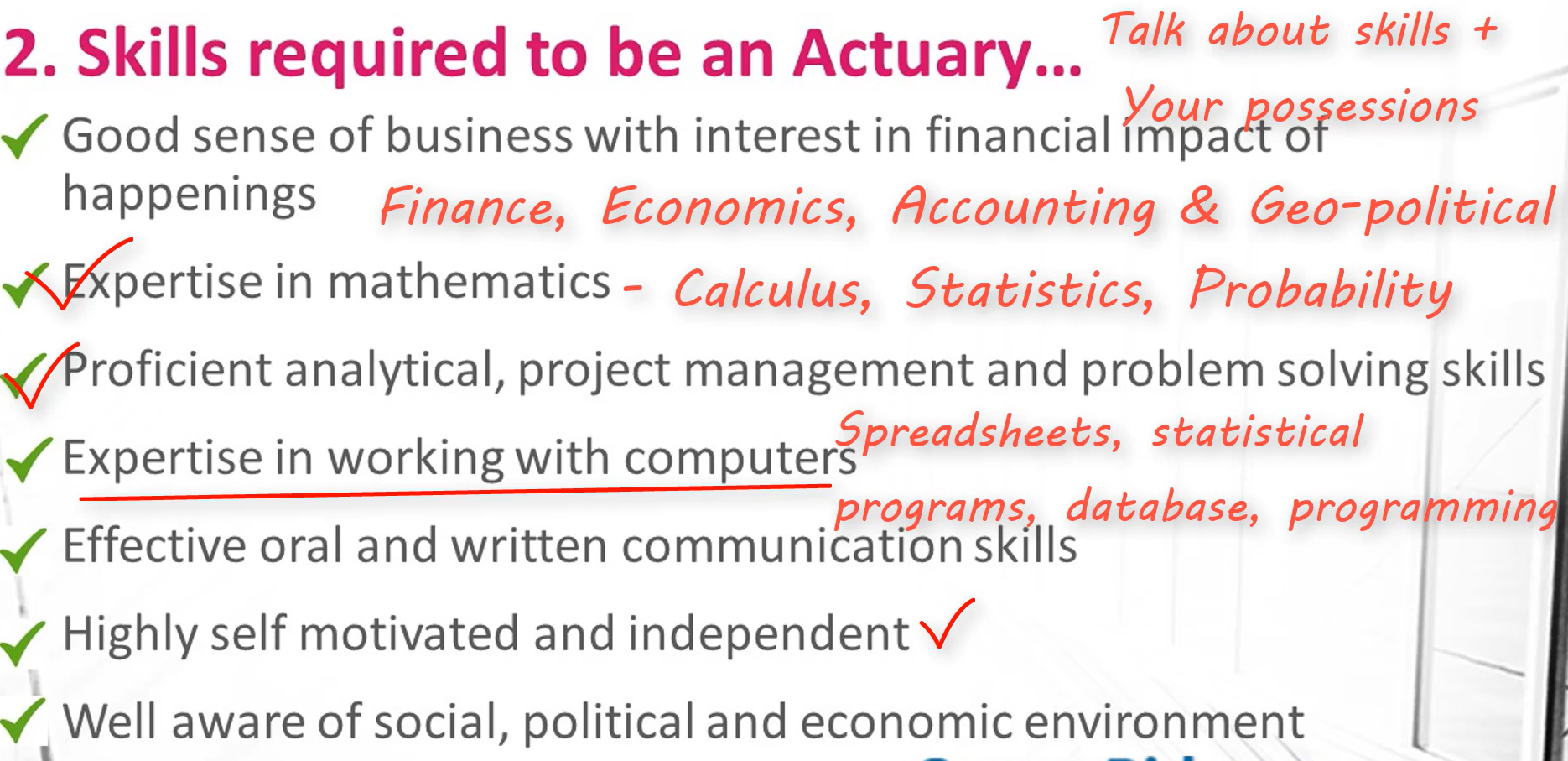

### Skills an actuarial analyst needs

Not everyone is cut out for the life of an actuarial analyst; it takes a very special set of skills. Thankfully, many of these skills are not inherent and can be developed through determination and hard work. These necessary skills are:

+ Specialized math knowledge in calculus, statistics, and probability

+ Analytical, project management, and problem solving skills

+ Finance, accounting, economics

+ Interpersonal communication

Computer skills such as simple coding, formulating spreadsheets, running statistical analysis programs, database manipulation, and programming languages

An actuarial analyst must be self-motivated, creative, both independent and collaborative at times, and have a strong sense of ambition. Having an understanding for the common industries that actuarial analysts are employed in such as insurance, banking, and government can also set you ahead as a candidate in the field.

## Actuarial Analyst Job Description Template

We are looking for a dedicated actuarial analyst with a strong statistics background to join our team. You will be using statistical modeling to analyze data relating to mortality, accidents, retirement, finance, etc. Other responsibilities include reporting to actuaries, providing technical support, and verifying the validity of data sources.

Successful candidates will be those who demonstrate exceptional critical thinking, possess a working knowledge of statistical analysis software, and can communicate complex statistical findings in an easy-to-understand way.

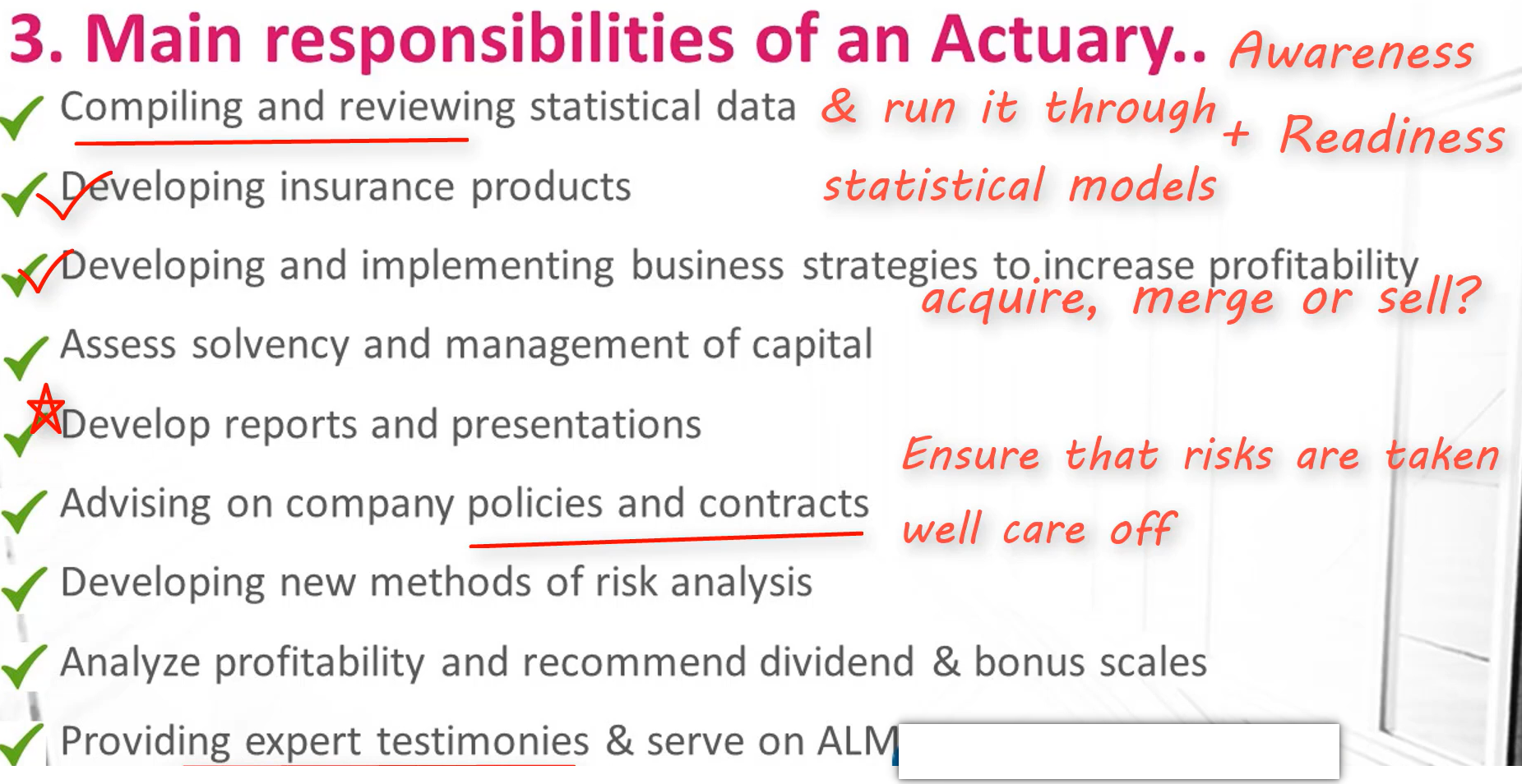

### **Actuarial Analyst Responsibilities:**

+ **Using advanced statistics and modeling to understand data.**

+ **Assisting actuaries with technical support and analysis.**

+ **Producing reports on analysis findings.**

+ **Identifying liabilities and risks.**

+ **Identifying trends.**

+ **Helping to design and price insurance policies.**

+ **Verifying data sources.**

+ **Identifying new sources of data.**

+ **Developing processes for improved data analysis and reporting.**

### **Actuarial Analyst Requirements:**

+ **Bachelor's degree in mathematics, statistics, or actuarial science.**

+ **Exceptional mathematical and statistical knowledge and understanding.**

+ **Experience with spreadsheets and databases.**

+ **Working knowledge of statistical analysis programs such as Insightful S-PLUS and Wolfram Research Mathematica.**

+ **Excellent critical thinking, problem-solving, and communication skills**

+ **General understanding of computers and electronics**

+ **Basic knowledge of laws, legal codes, regulations, etc.**

+ **Basic understanding of business and finance.**

## 1.6 ) 12 Types Of Actuaries And Their Role Description

Actuarial science is a field of mathematics which studies and quantifies financial risk using probability and statistics. Students of actuarial science analyze financial implications of future events using mathematical and statistical methods.

Insurance companies, pension providers and various financial firms employ different types of actuaries to analyze their risks and liabilities, improve their financial decision making and evaluate the impact of financial and economic events.

Many colleges and universities offer a graduate degree in actuarial science which consists of several interrelated subjects like mathematics, statistics, economics, finance, probability theory and computer science.

Getting a degree in actuarial science is challenging. You need to pass a series of actuarial exams that will make you a certified actuary. It requires that you have fairly good technical, mathematical and analytical skills.

### There are many different types of actuaries employed across various industries with insurance sector being the top recruiter. Let’s have a look at who they are and what they do.

+ **Life Insurance Actuary**

+ **Health Insurance Actuary**

+ **Pension Actuary**

+ **Property And Casualty Actuary**

+ **Enterprise Risk Management Actuary**

+ **Investment Actuary**

+ **Finance Actuary**

+ **Pricing Actuary**

+ **Valuation Actuary**

+ **Reinsurance Pricing Actuary**

+ **Corporate Actuary**

+ **Forensic Actuary**

### Life Insurance Actuary

Among all the actuaries, life insurance actuary is one of the most common. These types of actuaries work for insurance and reinsurance companies which offer products like whole life insurance and term life insurance.

Insurance companies sell thousands of policies every year. Life insurance actuaries help these companies to properly price the life insurance policy and determine the insurance premium for such policies.

Life insurance actuaries use mortality rates to find out the percentage of people that will die in any given year. The mortality rate for any person depends on various factors like age, gender and smoking status.

They use these mortality rates to find out what should be the insurance premium for different policies. Someone who is expected to live more than 30 years will pay lower premium than someone who is expected to live less than 10 years.

Life insurance claims are very hard to predict accurately as these are high cost low frequency claims. There is lot of variability involved in the amount insurance company has to pay each year.

Life insurance actuaries also have to take into account the lapse rate which is the rate at which the policyholders cancel their policies. High frequency of early cancellations can result in high insurance premiums because most of the expenses are incurred at the beginning of the policy.

### Health Insurance Actuary

Health insurance actuaries work with health insurance companies and help them to predict the actual cost of healthcare covered under insurance contract. These predictions are based on various factors like family history, occupation and geographical location.

Mostly health insurance actuaries are involved in designing group insurance plans which cover employer disability, dental, health and medication. They also provide policies to people who are self employed or employees who are not covered by their employer.

Actuaries that work in disability insurance try to predict how many policyholders will be unable to work each year and how much money insurance company will have to pay these policyholders to replace their lost income.

These types of actuaries also have to determine how soon the policy holder can get back to work because the longer the policyholder is out of work the longer the insurance company have to pay them.

Health insurance claims are fairly easy to predict accurately as these are considered as low cost high frequency claims. Health insurance actuaries use past data in order to predict how much money the policyholders will be spending on prescription drugs, dental benefits and health related sessions.

These types of actuaries use lot of data for analysis and most of the data is collected from policyholders. They also have to take into account the demographics, lapse rates, claim frequency and increasing medication costs.

### Pension Actuary

Pension actuaries are responsible for calculating the employer’s contribution as well as retirement benefits of pension plan participants. These types of actuaries help the plan sponsors to calculate sufficient balance required to fund the retirement benefits of pension plan participants.

These calculations are based on various assumptions about future events like retirement, disability, death and termination of employment. They also take into account the future economic events like interest rates and increase in salaries.

Pension actuaries do not deal with any insurance product but they create and price investment and annuity products which help the individuals to be financially prepared after retirement. These types of actuaries work with employers to develop retirement pension plans for employees.

Pension actuaries use current interest rates to determine the pricing of annuities. If interest rates rise, then the price of annuity will decrease as the insurance company will be able to earn more form increasing interest rates.

Pension actuaries try to predict how long people will live and how long people will be receiving payments. They also use mortality rates to determine the price of an annuity. Since mortality rates are higher among older people, pension actuaries would expect fewer annuity payments, hence reducing the price of the annuity.

### Property And Casualty Actuary

Property and casualty actuaries are one of the most common types of general actuaries or non-life actuaries. They work with general insurance companies and help them develop insurance policies that ensure against property loss and liabilities resulting from accidents, natural disasters or any other events.

These types of actuaries use their skills to analyze the risk emerging from climate change, ride sharing, automated vehicles and cyber liability. They are also responsible for pricing, predictive modeling, capital and risk management, strategic and financial management and catastrophe modeling.

Claims under property and casualty insurance are considered as high frequency low severity claims. These types of claims are easy to predict accurately. Vehicle insurance actuaries predict the probability of the policyholder getting into an accident and also the cost of the accident.

Property insurance actuaries determine the likelihood of property getting damaged from flooding, fire, extreme weather and anything else that can cause damage to the property. Such policy also covers for the loss due to theft of the items within the house.

Similar to health insurance actuaries, these types of actuaries also collect most of their data from policyholders. Demographics play an important role and due to high frequency of claims there is lot of data available for analysis.

Companies that provide property and casualty insurance in high crime areas will demand a higher premium for their insurance policies compared to the companies which insures people in low crime areas.

### Enterprise Risk Management Actuary

Enterprise risk management is a process of identifying critical risks faced by an organization, prioritizing them, quantifying their financial impact and developing organizational solutions to address them.

Primary responsibility of an enterprise risk management actuary is to consolidate all the risks which are faced by the company and determine the financial impact due to those risks. Their skills are not just limited to insurance companies.

One of the examples of an ERM actuary is to determine the cost and the potential impact of negative reputation on the organization. Any negative reputation would result in lower sales, lower revenue and legal charges.

Depending upon the severity, loss of reputation can even force the company to go out of business. The ERM actuary recognizes this and encourages the company to keep enough capital to survive such situations.

This is very important for insurance companies as thousands of people rely on them to collect insurance claims when the time comes. Enterprise risk management can prevent such companies from going out of business and protect their policyholders.

### Investment Actuary

Investment actuary is an actuary that either manages investments directly or provides an advice on how to manage investments. As with all the actuaries, their main focus tends to be on risk management.

Investment actuaries work in areas like investment banking, investment consulting, investment management and retail financial advice. They are also involved in day to day activities in capital markets, derivative markets, forex and property markets.

Investment actuaries have strong analytical skills and deep understanding about interaction between assets and liabilities which is very important while advising or managing assets backing insurance and pension liabilities.

### Finance Actuary

Finance actuaries work in areas like corporate finance, mergers and acquisitions, capital management and financial reporting. They have strong understanding about the working of insurance companies and other financial institutions.

Finance actuaries and financial analysts have very similar responsibilities as they both are involved in analyzing the data and reducing the risk of financial troubles. However, finance actuaries work closely with insurance companies whereas financial analysts are more focused on investment strategies.

The job responsibility of a finance actuary includes gathering data, performing calculations, evaluating investment options, determining the likelihood of any specific event occurring and recommending policies or investments to other people.

### Pricing Actuary

Pricing actuaries are statisticians who primarily work for financial industries or insurance companies. They use their analytical and math skills to determine the price of the products by analyzing data and calculating risks.

These types of actuaries collect and analyze statistical data to determine the claim payout in event of death, serious injury, property loss, disability or claims resulting from any casualties. They use this data to develop profitable yet competitive product pricing.

The decisions made by pricing actuaries should be high enough to cover the expenses and cost associated with insurance claims and to maximize the returns for insurance company. They are also involved in developing the policies and plans for new products and designing financially sound insurance and pension plans.

### Valuation Actuary

Valuation actuaries are responsible for calculating the reserves for life insurance and annuity companies, calculating the liabilities for financial statements and determining the valuation of the companies involved in mergers and acquisitions.

They ensure that the insurance company has enough reserves to pay for the expenses and claims that will be due in future. Once reserves are calculated they are also responsible for creating the source of earnings.

These types of actuaries use different valuation models to determine the reserves required by insurance company. In order to keep these valuation models up to date and accurate, they have to update the assumptions used in these models on an annual basis.

### Reinsurance Pricing Actuary

Like primary insurance, reinsurance is also a mechanism to spread out the risk. The reinsurer takes on some portion of the risk assumed by the primary insurer and charges an appropriate premium for that.

The main difference between reinsurance and primary insurance is that reinsurance contracts are more favorable to the buyer. The reinsurance pricing actuaries are responsible for estimating the risk and calculating the pricing of reinsurance contracts.

### Corporate Actuary

Corporate actuary is mostly involved either with product development or with financial reporting and valuation. They have special financial knowledge to analyze the results, feedback and the product pricing process.

Corporate actuaries also involved in corporate mergers and acquisitions, expense management, risk management, capital management, asset liability management and also in developing new performance measures for the company.

### Forensic Actuary

Forensic actuaries have a key role to play in providing litigation support in insurance and reinsurance cases. They serve as an expert witness where loss reserves and pricing issues are important. They can also act as arbitrators while resolving a dispute for insurance policy or reinsurance contract.

[Table of Content](#0.1)

___

# 2.) Actuarial science

It is a field of mathematics which studies and quantifies financial risk using probability and statistics. Students of actuarial science analyze financial implications of future events using mathematical and statistical methods.

Insurance companies, pension providers and various financial firms employ different types of actuaries to analyze their risks and liabilities, improve their financial decision making and evaluate the impact of financial and economic events.

Many colleges and universities offer a graduate degree in actuarial science which consists of several interrelated subjects like mathematics, statistics, economics, finance, probability theory and computer science.

Getting a degree in actuarial science is challenging. You need to pass a series of actuarial exams that will make you a certified actuary. It requires that you have fairly good technical, mathematical and analytical skills.

[Table of Content](#0.1)

___

# 3.) What is Risk?

Risk is an possibility of an adverse deviation from a desired outcome with uncertainty of expected or hoped for. Risk is the chance or probability that a person will be harmed or experience an adverse health effect if exposed to a hazard. It may also apply to situations with property or equipment loss, or harmful effects on the environment.

Risk probability, or likelihood, is the possibility of a risk event occurring. The likelihood can be expressed in both a qualitative and quantitative manner. When discussing probability in a qualitative manner, terms such as frequent, possible, rare etc. are used

#### Explanation

Risk Insurance shall involve assessing the price to be paid to Insurance policyholders who have suffered from the loss that occurred to them, which is covered by the policy. It involves various types of risks such as theft, loss, or damage of property or also may involve someone being injured; there is a chance that something unexpected or harmful may happen at any point in time.

It evolves in calculating the pay of the financial value for the damages that might occur to the insured property or item that might be lost, injured, or destroyed accidentally or often occur to happen. It also states how much it would cost to replace

or repair such an insured item to cover the loss suffered by the policyholder in case of such damage. Insurers shall calculate claims and evaluate their risks.

## 3.1) Types of Risks

The following are the different types of risk in insurance:

#### 1 – Pure Risk

Pure risk refers to the situation where it is certain that the outcome will lead to loss of the person only or maximum it could lead to the condition of the no loss to the person, but it can never cause profit to the person. An example of pure risk includes the possibility of damage to the house due to natural calamity.

In case any natural calamity occurs, it will damage the house of the person and its household items, or it will not affect the person’s home and household items. Still, this natural calamity will not give any profit or gain to the person. So, this will fall under the pure risk, and these risks are insurable.

#### 2 – Speculative Risk

Speculative risk refers to the situation where the direction of the outcome is not specific, i.e., it could lead to a condition of loss, profit, or no-loss. These risks are generally not insurable. An example of speculative risk includes the purchase of the shares of a company by a person.

Now, the prices of the shares can go in any direction, and a person can make either loss, profit, or no loss, no profit at the time of the sale of those shares. So, this will fall under the Speculative risk.

#### 3 – Financial Risk

Financial risk refers to the danger in which the outcome of the event is measurable in terms of the money, i.e., any loss that could occur due to the risk can be measured by the concerned person in monetary value. An example of financial risk includes a loss to the goods in the warehouse of the company due to the fire. These risks are insurable and are generally the main subjects of the insurance.

#### 4 – Non-Financial Risk

Non-Financial risk refers to the risk in which the outcome of the event is not measurable in terms of the money, i.e., any loss that could occur due to the risk cannot be measured by the concerned person in the monetary value. An example of the non-financial risk includes the risk of poor selection of the brand while purchasing mobile phones. These risks are uninsurable since they cannot be measured.

#### 5 – Particular Risk

Particular risk refers to the risk which arises mainly because of the actions or the interventions of the individual or the group of some individuals. So, the origin of the particular risk by individual-level and impact of the same is felt at a localized level. An example of a specific chance includes an accident on the bus. These risks are insurable and are generally the main subjects of the insurance.

#### 6 – Fundamental Risk

Fundamental risk refers to the risk which arises due to the causes which are not under the control of any person. So, it can be said that the fundamental risk is impersonal in its origin and the consequences. The impact of these risks is essentially on the group, i.e., it affects the large population. The fundamental risk includes risks on the group by events such as natural calamity, economic slowdown, etc. These risks are insurable.

##### Fundamental risk vs. particular risk

Fundamental risk is risk that affects entire societies or a large population within a society. Natural disasters, such as earthquakes and hurricanes, fall into the category of fundamental risk, as do phenomena such as inflation and war, which typically affect large numbers of people. In distinction to static risk, fundamental risk may or may not be insurable.

Particular risk, in contrast to fundamental risk, refers to risks that affect an individual, such as a fire that destroys a family home, theft of a car or robbery. Particular risk can be insured.

#### 7 – Static Risk

Static risk refers to the risk which remains constant over the period and is generally not affected by the business environment. These risks arise from human mistakes or actions of nature. An example of static risk includes the embezzlement of funds in a company by its employees. They are generally easily insurable as they are easy to measure.

#### 8 – Dynamic Risk

Dynamic risk refers to the risk which arises when there are any changes in the economy. These risks are generally not easy to predict. These changes might bring financial losses to the members of the economy. An example of the dynamic risk includes the changes in the income of the persons in an economy, their tastes, preferences, etc. They are generally not easily insurable.

##### Static risk vs. dynamic risk

Static risk is a type of pure risk that is predictable, measurable and doesn't change. It is a type of pure risk because it is not chosen and no financial gain can come from static risk.

Insuranceopedia, an online repository of financial information and insurance definitions, defines static risk as "risks that involve losses brought about by acts of nature or by malicious and criminal acts by another person. These losses refer to damage or loss to property or entity that is not caused by the economy." A flood is an example of static risk. According to Insuranceopedia, static risks "are more easily taken care of by insurance coverage because of their relative predictability."

Dynamic risk, in contrast to static risk, is a "risk brought on by sudden and unpredictable changes in the economy," according to Insuranceopedia. This type of risk is difficult to measure, sometimes resulting in sizable losses for individuals and businesses. Insuranceopedia pointed to the COVID-19 pandemic as an example of dynamic risk, not only due its unpredictability, but also its impact on many lines of insurance coverage, including business interruption, trade credit and cyber liability insurance. A recession is another example of a dynamic risk, as well as a fundamental risk.

### 3.2) What Is Financial Risk?

Financial risk is the possibility of losing money in a business venture or investment. There are several types of financial risks, such as credit risk, liquidity risk, and operational risk. A financial risk is a potential loss of capital to an interested party.

In other words, financial risk is a danger that can translate into the loss of capital. It relates to the odds of money loss.

In case of a financial risk, there is a possibility that a company’s cash flow might prove insufficient to satisfy its obligations. Some common financial risks are credit, operational, foreign investment, legal, equity, and liquidity risks.

In government sectors, financial risk implies the inability to control monetary policy and or other debt issues. Learn more about how financial risk is associated with different sectors, be it business, government, market, or individuals.

#### Types of Financial Risks

Risk can be referred to like the chances of having an unexpected or negative outcome. Any action or activity that leads to loss of any type can be termed as risk. There are different types of risks that a firm might face and needs to overcome. Widely, risks can be classified into three types: Business Risk, Non-Business Risk, and Financial Risk.

+ **Business Risk:** These types of risks are taken by business enterprises themselves in order to maximize shareholder value and profits. As for example, companies undertake high-cost risks in marketing to launch a new product in order to gain higher sales.

+ **Non- Business Risk:** These types of risks are not under the control of firms. Risks that arise out of political and economic imbalances can be termed as non-business risk.

+ **Financial Risk:** Financial Risk as the term suggests is the risk that involves financial loss to firms. Financial risk generally arises due to instability and losses in the financial market caused by movements in stock prices, currencies, interest rates and more.

### Types of Financial Risks

Risk Types: The different types of risks are categorized in several different ways. Risks are classified into some categories, including market risk, credit risk, operational risk, strategic risk, liquidity risk, and event risk.

Financial risk is one of the high-priority risk types for every business. Financial risk is caused due to market movements and market movements can include a host of factors. Based on this, financial risk can be classified into various types such as Market Risk, Credit Risk, Liquidity Risk, Operational Risk, and Legal Risk.

#### Market Risk:

This type of risk arises due to the movement in prices of financial instrument. Market risk can be classified as Directional Risk and Non-Directional Risk. Directional risk is caused due to movement in stock price, interest rates and more. Non-Directional risk, on the other hand, can be volatility risks.

#### Credit Risk:

This type of risk arises when one fails to fulfill their obligations towards their counterparties. Credit risk can be classified into Sovereign Risk and Settlement Risk. Sovereign risk usually arises due to difficult foreign exchange policies. Settlement risk, on the other hand, arises when one party makes the payment while the other party fails to fulfill the obligations.

#### Liquidity Risk:

This type of risk arises out of an inability to execute transactions. Liquidity risk can be classified into Asset Liquidity Risk and Funding Liquidity Risk. Asset Liquidity risk arises either due to insufficient buyers or insufficient sellers against sell orders and buys orders respectively.

#### Operational Risk:

This type of risk arises out of operational failures such as mismanagement or technical failures. Operational risk can be classified into Fraud Risk and Model Risk. Fraud risk arises due to the lack of controls and Model risk arises due to incorrect model application.

#### Legal Risk:

This type of financial risk arises out of legal constraints such as lawsuits. Whenever a company needs to face financial losses out of legal proceedings, it is a legal risk.

[Table of Content](#0.1)

___

# 4.) What is Insurance?

Represented in a form of policy, Insurance is a contract in which the individual or an entity gets the financial protection, in other words, reimbursement from the insurance company for the damage (big or small) caused to their property.

The insurer and the insured enter a legal contract for the insurance called the insurance policy that provides financial security from the future uncertainties.

In simple words, insurance is a contract, a legal agreement between two parties, i.e., the individual named insured and the insurance company called insurer. In this agreement, the insurer promises to help with the losses of the insured on the happening contingency. The insured, on the other hand, pays a premium in return for the promise made by the insurer.

The contract of insurance between an insurer and insured is based on certain principles, let us know the principles of insurance in detail.

#### What’s a Health Insurance Premium?

A health insurance premium is the upfront cost of maintaining health insurance coverage. Most premiums are paid on a monthly or biweekly basis. If your healthcare is provided by your employer, they will usually deduct the premium from your paycheck.

## 4.1 ) Principles of Insurance

The concept of insurance is risk distribution among a group of people. Hence, cooperation becomes the basic principle of insurance.

To ensure the proper functioning of an insurance contract, the insurer and the insured have to uphold the 7 principles of Insurances mentioned below:

+ Utmost Good Faith

+ Proximate Cause

+ Insurable Interest

+ Indemnity

+ Subrogation

+ Contribution

+ Loss Minimization

Let us understand each principle of insurance with an example.

#### Principle of Utmost Good Faith

The fundamental principle is that both the parties in an insurance contract should act in good faith towards each other, i.e. they must provide clear and concise information related to the terms and conditions of the contract.

The Insured should provide all the information related to the subject matter, and the insurer must give precise details regarding the contract.

Example – Jacob took a health insurance policy. At the time of taking insurance, he was a smoker and failed to disclose this fact. Later, he got cancer. In such a situation, the Insurance company will not be liable to bear the financial burden as Jacob concealed important facts.

#### Principle of Proximate Cause

This is also called the principle of ‘Causa Proxima’ or the nearest cause. This principle applies when the loss is the result of two or more causes. The insurance company will find the nearest cause of loss to the property. If the proximate cause is the one in which the property is insured, then the company must pay compensation. If it is not a cause the property is insured against, then no payment will be made by the insured.

Example –

+ **Due to fire, a wall of a building was damaged, and the municipal authority ordered it to be demolished. While demolition the adjoining building was damaged. The owner of the adjoining building claimed the loss under the fire policy. The court held that fire is the nearest cause of loss to the adjoining building, and the claim is payable as the falling of the wall is an inevitable result of the fire.**

+ **In the same example, the wall of the building damaged due to fire, fell down due to storm before it could be repaired and damaged an adjoining building. The owner of the adjoining building claimed the loss under the fire policy. In this case, the fire was a remote cause, and the storm was the proximate cause; hence the claim is not payable under the fire policy.**

#### Principle of Insurable interest

This principle says that the individual (insured) must have an insurable interest in the subject matter. Insurable interest means that the subject matter for which the individual enters the insurance contract must provide some financial gain to the insured and also lead to a financial loss if there is any damage, destruction or loss.

Example – the owner of a vegetable cart has an insurable interest in the cart because he is earning money from it. However, if he sells the cart, he will no longer have an insurable interest in it.

To claim the amount of insurance, the insured must be the owner of the subject matter both at the time of entering the contract and at the time of the accident.

#### Principle of Indemnity

This principle says that insurance is done only for the coverage of the loss; hence insured should not make any profit from the insurance contract. In other words, the insured should be compensated the amount equal to the actual loss and not the amount exceeding the loss. The purpose of the indemnity principle is to set back the insured at the same financial position as he was before the loss occurred. Principle of indemnity is observed strictly for property insurance and not applicable for the life insurance contract.

Example – The owner of a commercial building enters an insurance contract to recover the costs for any loss or damage in future. If the building sustains structural damages from fire, then the insurer will indemnify the owner for the costs to repair the building by way of reimbursing the owner for the exact amount spent on repair or by reconstructing the damaged areas using its own authorized contractors.

#### Principle of Subrogation

Subrogation means one party stands in for another. As per this principle, after the insured, i.e. the individual has been compensated for the incurred loss to him on the subject matter that was insured, the rights of the ownership of that property goes to the insurer, i.e. the company.

Subrogation gives the right to the insurance company to claim the amount of loss from the third-party responsible for the same.

Example – If Mr A gets injured in a road accident, due to reckless driving of a third party, the company with which Mr A took the accidental insurance will compensate the loss occurred to Mr A and will also sue the third party to recover the money paid as claim.

#### Principle of Contribution

Contribution principle applies when the insured takes more than one insurance policy for the same subject matter. It states the same thing as in the principle of indemnity, i.e. the insured cannot make a profit by claiming the loss of one subject matter from different policies or companies.

Example – A property worth Rs. 5 Lakhs is insured with Company A for Rs. 3 lakhs and with company B for Rs.1 lakhs. The owner in case of damage to the property for 3 lakhs can claim the full amount from Company A but then he cannot claim any amount from Company B. Now, Company A can claim the proportional amount reimbursed value from Company B.

#### Principle of Loss Minimisation

This principle says that as an owner, it is obligatory on the part of the insurer to take necessary steps to minimise the loss to the insured property. The principle does not allow the owner to be irresponsible or negligent just because the subject matter is insured.

Example – If a fire breaks out in your factory, you should take reasonable steps to put out the fire. You cannot just stand back and allow the fire to burn down the factory because you know that the insurance company will compensate for it.

#### Pure Risk vs. Speculative Risk

Insurance companies normally only indemnify against pure risks, otherwise known as event risks. A pure risk includes any uncertain situation where the opportunity for loss is present and the opportunity for financial gain is absent.

Speculative risks are those that might produce a profit or loss, namely business ventures or gambling transactions. Speculative risks lack the core elements of insurability and are almost never insured.

Examples of pure risks include natural events, such as fires or floods, or other accidents, such as an automobile crash or an athlete seriously injuring his or her knee. Most pure risks can be divided into three categories: personal risks that affect the income-earning power of the insured person, property risks, and liability risks that cover losses resulting from social interactions. Not all pure risks are covered by private insurers.

### 4.2 ) Types Of Insurance

There are two broad categories of insurance:

#### 1. Life Insurance

#### 2. General insurance

**Life Insurance –** The insurance policy whereby the policyholder (insured) can ensure financial freedom for their family members after death. It offers financial compensation in case of death or disability.

While purchasing the life insurance policy, the insured either pay the lump-sum amount or makes periodic payments known as premiums to the insurer. In exchange, of which the insurer promises to pay an assured sum to the family if insured in the event of death or disability or at maturity.

Depending on the coverage, life insurance can be classified into the below-mentioned types:

+ Term Insurance: Gives life coverage for a specific time period.

+ Whole life insurance: Offer life cover for the whole life of an individual

+ Endowment policy: a portion of premiums go toward the death benefit, while the remaining is invested by the insurer.

+ Money back Policy: a certain percentage of the sum assured is paid to the insured in intervals throughout the term as survival benefit.

+ Pension Plans: Also called retirement plans are a fusion of insurance and investment. A portion from the premiums is directed towards retirement corpus, which is paid as a lump-sum or monthly payment after the retirement of the insured.

+ Child Plans: Provides financial aid for children of the policyholders throughout their lives.

+ ULIPS – Unit Linked Insurance Plans: same as endowment plans, a part of premiums go toward the death benefit while the remaining goes toward mutual fund investments.

**General Insurance** – Everything apart from life can be insured under general insurance. It offers financial compensation on any loss other than death. General insurance covers the loss or damages caused to all the assets and liabilities. The insurance company promises to pay the assured sum to cover the loss related to the vehicle, medical treatments, fire, theft, or even financial problems during travel.

General Insurance can cover almost anything, and everything but the five key types of insurances available under it are –

+ Health Insurance: Covers the cost of medical care.

+ Fire Insurance: give coverage for the damages caused to goods or property due to fire.

+ Travel Insurance: compensates the financial liabilities arising out of non-medical or medical emergencies during travel within the country or abroad

+ Motor Insurance: offers financial protection to motor vehicles from damages due to accidents, fire, theft, or natural calamities.

+ Home Insurance: compensates the damage caused to home due to man-made disasters, natural calamities, or other threats

### What is the difference between “P&C” and “Life Insurance”?

Insurance companies provide a guaranteed payment for an unforeseen future event. The party receiving the payment, the insured, pays a premium for this guarantee. Insurance companies also generate investment income by investing the cash premiums received in the financial markets.

Although this basic concept remains constant throughout the sector, the types of events that are covered by each insurance company vary and so do the associated risks and risk mitigation strategies.

Property and casualty (P&C) insurance, also known as general insurance, is a type of insurance that covers damages to property or a business. This umbrella term covers multiple types of insurance such as auto insurance, home insurance, commercial insurance, and marine insurance. The main risk associated with this sector is underwriting risk which is the risk that income from policies may not be sufficient to cover claims and is usually managed using reinsurance.

Life insurance covers the risk of the death of a policyholder. The policy owner selects beneficiaries who will receive payments upon the policy owner’s death in exchange for premiums paid to the insurance company. The main risk in this sector is longevity risk, which has to do with the uncertainty of the estimated life expectancy of the policyholders. To manage this risk, life insurance policies generally also provide retirement products, which carry the inverse risk to longevity risk, known as mortality risk.

Beyond the above-mentioned differences, the time horizon between the two varies significantly as well; P&C insurance lasts for a few years, whereas life insurance policies last for decades.

### P&C Insurance Risks

One of the major risks that P&C insurance companies face are catastrophes – hurricanes, floods, and earthquakes. These create underwriting risks where the premiums may not be sufficient to cover future claims. Stop-loss reinsurance is important for managing this risk. Stop-loss reinsurance is a type of excess of loss reinsurance wherein the reinsurer is liable for the insured’s losses incurred over a certain period (usually a year) that exceed a specified dollar amount or percentage of some business measure, such as earned premiums written, up to the policy limit.

P&C insurers also face market risk through their investment portfolio, where changes in market conditions can affect their investment portfolio. This is managed by having a diverse portfolio which reduces the effect of adverse movements within single assets within the portfolio.

### Life Insurance Risks

Actuaries working for life insurance companies use mortality tables to make informed assumptions of the expected lifespan of their policyholders. Life insurance companies subsequently face longevity risk and mortality risk.

Longevity risk refers to the chance that life expectancies and actual survival rates exceed projections or pricing assumptions, resulting in greater-than-anticipated cash flow needs on the part of insurance companies. This risk is usually managed with reinsurance and by diversifying the range of products offered.

The mortality risk is the risk that an insurance company can suffer financially because too many of their life insurance policyholders die before their expected lifespans. To mitigate against this risk, life insurance companies sell retirement products. Retirement products provide a natural hedge against mortality risk.

Life insurance companies also face interest rate risk, a type of market risk, on both investment portfolios and future payments to beneficiaries. Since payments are guaranteed long-term, the present value of the payments are affected by changes in future interest rates. This risk is managed by ensuring that cash flow from their investments are well-matched with expected pay-outs on policies. This is achieved by making investments that have similar long-term time horizons to the insurance products.

### 4.3 ) What Is Liability Insurance?

Liability insurance is an insurance product that provides protection against claims resulting from injuries and damage to other people or property. Liability insurance policies cover any legal costs and payouts an insured party is responsible for if they are found legally liable. Intentional damage and contractual liabilities are generally not covered in liability insurance policies.

Unlike other types of insurance, liability insurance policies pay third parties, and not policyholders.

#### How Liability Insurance Works

Liability insurance is critical for those who are liable and at fault for injuries sustained by other people or in the event that the insured party damages someone else's property. As such, liability insurance is also called third-party insurance. Liability insurance does not cover intentional or criminal acts even if the insured party is found legally responsible. Policies are taken out by anyone who owns a business, drives a car, practices medicine or law—basically anyone who can be sued for damages and/or injuries. Policies protect both the insured and third parties who may be injured as a result of the policyholder's unintentional negligence.

For instance, most states require that vehicle owners have liability insurance under their automotive insurance policies to cover injury to other people and property in the event of accidents. A product manufacturer may purchase product liability insurance to cover them if a product is faulty and causes damage to the purchasers or another third party. Business owners may purchase liability insurance that covers them if an employee is injured during business operations. The decisions doctors and surgeons make while on the job also require liability insurance policies.

#### Types of Liability Insurance

Business owners are exposed to a range of liabilities, any of which can subject their assets to substantial claims. All business owners need to have an asset protection plan in place that's built around available liability insurance coverage.

##### Here are the main types of liability insurance:

+ **Employer’s liability and workers' compensation** is mandatory coverage for employers which protects the business against liabilities arising from injuries or the death of an employee.

+ **Product liability insurance** is for businesses that manufacture products for sale on the general market. Product liability insurance protects against lawsuits arising from injury or death caused by their products.

+ **Indemnity insurance** provides coverage to protect a business against negligence claims due to financial harm resulting from mistakes or failure to perform.

+ **Director and officer liability coverage** covers a company's board of directors or officers against liability if the company should be sued. Some companies provide additional protection to their executive team even though corporations generally provide some degree of personal protection to their employees.

+ **Umbrella liability policies** are personal liability policies designed to protect against catastrophic losses. Coverage generally kicks in when the liability limits of other insurance are reached.

+ **Commercial liability insurance** is a standard commercial general liability policy also known as comprehensive general liability insurance. It provides insurance coverage for lawsuits arising from injury to employees and the public, property damage caused by an employee, as well as injuries suffered by the negligent action of employees. The policy may also cover infringement on intellectual property, slander, libel, contractual liability, tenant liability, and employment practices liability.

+ **Comprehensive general liability policies** are tailor-made for any small or large business, partnership or joint venture businesses, a corporation or association, an organization, or even a newly acquired business. Insurance coverage includes bodily injury, property damage, personal and advertising injury, medical payments, and premises and operations liability. Insurers provide coverage for compensatory and general damages for lawsuits but not punitive damages.

### Definition of Administrative services only (ASO)

ASO is a self-funded employee benefits plan structure made by the employer. The employer is then exclusively liable for all of the financial and legal aspects of the plan.

Most often the employer hires an outside firm to administer the plan and process claims and payments. For instance, a firm can hire an insurance company in order to assess and proceed claims under its employee health plan, while retaining the responsibility to pay the claims itself.

#### Benefits and usage of ASO

In an ASO, yearly funding levels are based on actual paid claims, while fully-insured plans are affected by the insurer's evaluation of anticipated claims for a chosen year. When given claims come to be less then anticipated, employers keep the surplus and that can be reinvested. However, when budgeted amounts are exceeded the employer is held responsible.

ASO plans are convinient for benefits such as short term disability, extended health and dental care, but may not be suitable for life insurance and high extended health care plans. It is up to the employer to weigh the risks and benefits of how different ASO arrangements may impact their organizations.

### 4.4) Characteristics of an Ideally Insurable Risk

Private insurers generally insure only pure risks. However, some pure risks are not privately insurable. From the viewpoint of a private insurer, an insurable risk ideally should have certain characteristics. There are ideally six characteristics of an insurable risk:

+ **There must be a large number of exposure units.**

+ **The loss must be accidental and unintentional.**

+ **The loss must be determinable and measurable.**

+ **The loss should not be catastrophic.**

+ **The chance of loss must be calculable.**

+ **The premium must be economically feasible.**

Most insurance providers only cover pure risks, or those risks that embody most or all of the main elements of insurable risk. These elements are "due to chance," definiteness and measurability, statistical predictability, lack of catastrophic exposure, random selection, and large loss exposure.

#### Due to Chance

An insurable risk must have the prospect of accidental loss, meaning that the loss must be the result of an unintended action and must be unexpected in its exact timing and impact.

The insurance industry normally refers to this as "due to chance." Insurers only pay out claims for loss events brought about through accidental means, though this definition may vary from state to state. It protects against intentional acts of loss, such as a landlord burning down his or her own building.

#### Definiteness and Measurability

For a loss to be covered, the policyholder must be able to demonstrate a definite proof of loss, normally in the form of bills in a measurable amount. If the extent of the loss cannot be calculated or cannot be fully identified, then it is not insured. Without this information, an insurance company can neither produce a reasonable benefit amount or premium cost.

#### Statistically Predictable

Insurance is a game of statistics, and insurance providers must be able to estimate how often a loss might occur and the severity of the loss. Life and health insurance providers, for example, rely on actuarial science and mortality and morbidity tables to project losses across populations.(the word morbidity refers to the incidence or prevalence of a disease in a specific population or location (sometimes called the morbidity rate), while the word mortality refers to relative frequency of deaths in a specific population or location (sometimes called the mortality rate).)

#### Not Catastrophic

Standard insurance does not guard against catastrophic perils. It might be surprising to see an exclusion against catastrophes listed among the core elements of an insurable risk, but it makes sense given the insurance industry's definition of catastrophic, often abbreviated as "cat."

There are two kinds of catastrophic risk. The first is present whenever all or many units within a risk group, such as the policyholders in that class of insurance, are all be exposed to the same event. Examples of this kind of catastrophic risk include nuclear fallout, hurricanes, or earthquakes.

The second kind of catastrophic risk involves any unpredictably large loss of value not anticipated by either the insurer or the policyholder. Perhaps the most infamous example of this kind of catastrophic event occurred during the terrorist attacks on Sept. 11, 2001.

Some insurance companies specialize in catastrophic insurance, and many insurance companies enter into reinsurance agreements to guard against catastrophic events. Investors can even purchase risk-linked securities, called "cat bonds," which raise money for catastrophic risk transfers.

#### Randomly Selected and Large Loss Exposure

All insurance schemes operate based on the law of large numbers. This law states there must be a sufficient large number of homogeneous exposures to any specific event in order to make a reasonable prediction about the loss related to an event.

A second related rule is that the number of exposure units, or policyholders, must also be large enough to encompass a statistically random sample of the overall population. This is designed to prevent insurance companies from only spreading risk among those most likely to generate a claim, as might occur under adverse selection.

[Table of Content](#0.1)

___

# 5.) What Is the Morbidity Rate?

Morbidity rate refers to the rate at which a disease or illness occurs in a population and can be used to determine the health of a population and its healthcare needs. Illnesses can range from acute to chronic, long-lasting conditions.

Morbidity rates are also used in actuarial professions, such as health insurance, life insurance, and long-term care insurance, to determine the premiums to charge customers. This rate shouldn't be confused with the mortality rate, another metric used to highlight the frequency of death in a given population.

[Table of Content](#0.1)

___

# 6.) What Is the Law of Large Numbers?

The law of large numbers, in probability and statistics, states that as a sample size grows, its mean gets closer to the average of the whole population. This is due to the sample being more representative of the population as the sample become larger.

#### Understanding the Law of Large Numbers

The law of large numbers can refer to two different topics. First, in statistical analysis, the law of large numbers can be applied to a variety of subjects. It may not be feasible to poll every individual within a given population to collect the required amount of data, but every additional data point gathered has the potential to increase the likelihood that the outcome is a true measure of the mean.

The law of large numbers does not mean that a given sample or group of successive samples will always reflect the true population characteristics, especially for small samples. This also means that if a given sample or series of samples deviates from the true population average, the law of large numbers does not guarantee that successive samples will move the observed average toward the population mean.

Second, the term "law of large numbers" is sometimes used in business in relation to growth rates, stated as a percentage. It suggests that, as a business expands, the percentage rate of growth becomes increasingly difficult to maintain. This is because the underlying dollar amount is actually increasing even if the growth rate as a percentage is to remain constant.

#### Law of Large Numbers and Statistical Analysis

If a person wanted to determine the average value of a data set of 100 possible values, he is more likely to reach an accurate average by choosing 20 data points instead of relying on just two. This is because there is greater probability of the two data points being outliers or non-representative of the average, while there is lower probability in all 20 data points being non-representative.

For example, if the data set included all integers from one to 100, and sample-taker only drew two values, such as 95 and 40, he may determine the average to be approximately 67.5. If he continued to take random samplings up to 20 variables, the average should shift towards the true average as he considers more data points.

#### Law of Large Numbers and Central Limit Theorem

In statistical analysis, the law of large numbers is related to the central limit theorem. The central limit theorem states that as the sample size increases, the sample mean will be evenly distributed. This is often depicted as a bell-shaped curve where the peak of the curve depicts the mean and even distributions of sample data fall to the left and right of the curve.

In a related manner, the law of large numbers also states that data is refined as the sample grows. However, the law of large numbers more closely relates to the center of the bell curve. The law of large numbers indicates that as a sample size increases, the mean of the sample will more closely resemble the mean of the population. Therefore, the law of large numbers relates to the peak (the mean) of a curve, while the central limit theorem relates to the distribution of a curve.

#### Law of Large Numbers in Business Example

In fiscal year 2020, Tesla reported automotive sales (not gross sales) of $24.604 billion. The next year, the company reported $44.125 billion, an increase of roughly 79%.

As electric vehicles are an emerging market and Tesla is beginning to finally experience economies of scale, the company is started to experience success very quickly.

The law of large numbers indicates that as Tesla continues to grow, it will become harder for the company to maintain this level of productivity. For example, assuming a steady growth rate of the next several years, it becomes quickly apparent that Tesla simply cannot maintain its current growth trajectory due to the underlying dollar values becoming unreasonable.

[Table of Content](#0.1)

___

# 7.) Insurance obligation

what it means, is that on any date, the sum of (a) all Reimbursement Amounts, (b) all accrued and unpaid premium and charges for "Unutilized Credit Limit Capacity" under the Insurance Policy and (c) all other accrued and unpaid amounts then due and payable to the Insurer under the Insurance Policy and any other Transaction Document.

**Obligation #1:** An insurer must treat its insured’s interests with the same consideration it gives its own interests. This means that a claims adjuster must give the policy holder the benefit of the doubt. The claims adjuster should be looking for reasons to find coverage, not for reasons to deny coverage. The claims adjuster should be looking for reasons to pay the claim, not reasons to deny it. Unfortunately, sometimes insurance companies lose sight of this fundamental rule.

**Obligation #2:** The claims adjuster has a duty to help the policy holder with the claim. A claims adjuster should help explain coverage and available benefits to the policy holder and should take other steps to help bring the claim to a prompt and fair conclusion. Claims adjusters should not view the process as insurance company versus policy holder.

**Obligation #3:** The insurer must promptly and fairly investigate every claim. This obligation may best be illustrated by an example. A firm handled a case where the claims adjuster for the client’s insurance company did not obtain medical records, interview witnesses, or evaluate the claim in any meaningful way for a period of 2 ½ years. They did not promptly and fairly investigate the client’s claim.

**Obligation #4:** If payment is owed, an insurer must promptly pay the claim. In Wisconsin, an insurer must pay a claim that is owed within 30 days, or the insurer may be subject to paying the policy holder 12 percent interest per year. Even though this is the law, there is no good reason for an insurance company to hold payment for 30 days if it owes benefits under a policy.

**Obligation #5:** If the insurer denies the claim, it must give an explanation to the policy holder. An insurance company cannot simply refuse payment of a policy holder’s claim without an explanation. A policy holder has a right to know the reasons that payment of a claim is being denied so that he or she can respond appropriately.

**Obligation #6:** The insurer must disclose significant facts to its policy holder. Throughout its investigation into a claim, the insurer must tell the policy holder about significant facts or circumstances it uncovers. An insurer has investigators and others experienced in the claims process. They are in the best position to conduct an investigation. In fact, if a policy holder takes certain actions or compromises an investigation, an insurer may argue that coverage has been voided. Because of the unique nature of the insurer/insured relationship and the realities of the claims process, an insurance company must disclose significant facts to its policy holder.

Again, insurance companies must treat their insureds fairly and reasonably. If an insurer violates one or more of its obligations to you, may have committed bad faith.

#### What is the meaning by obligation?

An act of making oneself responsible for doing something(as a promise or contract) that requires one to do something.

#### What is an example of a obligation?

For example, if you owe or will owe money to anybody, that is one of your financial obligations. Almost any form of payment or financial security represents a financial obligation.

[Table of Content](#0.1)

___

# 8.) What Is Reinsurance?

Reinsurance is also known as insurance for insurers or stop-loss insurance. Reinsurance is the practice whereby insurers transfer portions of their risk portfolios to other parties by some form of agreement to reduce the likelihood of paying a large obligation resulting from an insurance claim.

The party that diversifies its insurance portfolio is known as the ceding party. The party that accepts a portion of the potential obligation in exchange for a share of the insurance premium is known as the reinsurer.

### 8.1 ) How Reinsurance Works

Reinsurance allows insurers to remain solvent(having assets in excess of liabilities; able to pay one's debts) by recovering some or all amounts paid to claimants. Reinsurance reduces the net liability on individual risks and catastrophe protection from large or multiple losses. The practice also provides ceding companies, those that seek reinsurance, the capacity to increase their underwriting capabilities in terms of the number and size of risks.

According to the Insurance Information Institute, Hurricane Andrew caused $15.5 billion in damage in Florida in 1992, causing seven U.S. insurance companies to become insolvent(unable to pay debts owed).

By spreading risk, an individual insurance company can take on clients whose coverage would be too great of a burden for the single insurance company to handle alone. When reinsurance occurs, the premium paid by the insured is typically shared by all of the insurance companies involved.

If one company assumes the risk on its own, the cost could bankrupt or financially ruin the insurance company and possibly not cover the loss for the original company that paid the insurance premium.

For example, consider a massive hurricane that makes landfall in Florida and causes billions of dollars in damage. If one company sold all the homeowners insurance, the chance of it being able to cover the losses would be unlikely. Instead, the retail insurance company spreads parts of the coverage to other insurance companies (reinsurance), thereby spreading the cost of risk among many insurance companies.

Insurers purchase reinsurance for four reasons: To limit liability on a specific risk, to stabilize loss experience, to protect themselves and the insured against catastrophes, and to increase their capacity. But reinsurance can help a company by providing the following:

+ **Risk Transfer:** Companies can share or transfer specific risks with other companies.

+ **Arbitrage:** Additional profits can be garnered by purchasing insurance elsewhere for less than the premium the company collects from policyholders.