https://github.com/paradite/retire-at-35

:dart: Principles of "Retire at 35"

https://github.com/paradite/retire-at-35

early-retirement finance financial-independence fire retire retirement

Last synced: 6 months ago

JSON representation

:dart: Principles of "Retire at 35"

- Host: GitHub

- URL: https://github.com/paradite/retire-at-35

- Owner: paradite

- Created: 2020-12-29T17:59:58.000Z (almost 5 years ago)

- Default Branch: main

- Last Pushed: 2023-06-08T08:29:19.000Z (over 2 years ago)

- Last Synced: 2025-03-30T21:33:11.138Z (7 months ago)

- Topics: early-retirement, finance, financial-independence, fire, retire, retirement

- Language: JavaScript

- Homepage: https://retire35.com/

- Size: 2.49 MB

- Stars: 30

- Watchers: 2

- Forks: 2

- Open Issues: 0

-

Metadata Files:

- Readme: README.md

Awesome Lists containing this project

README

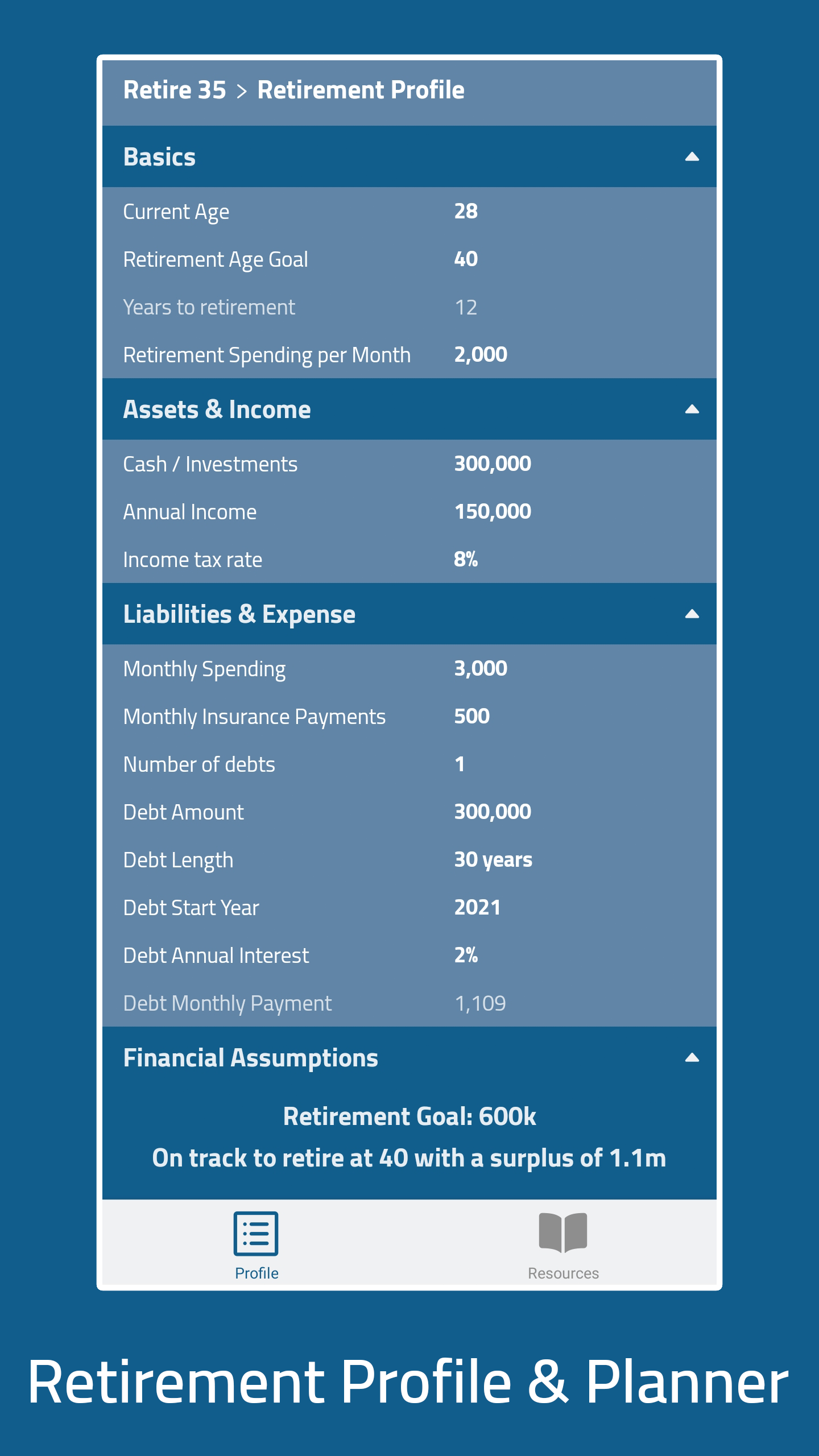

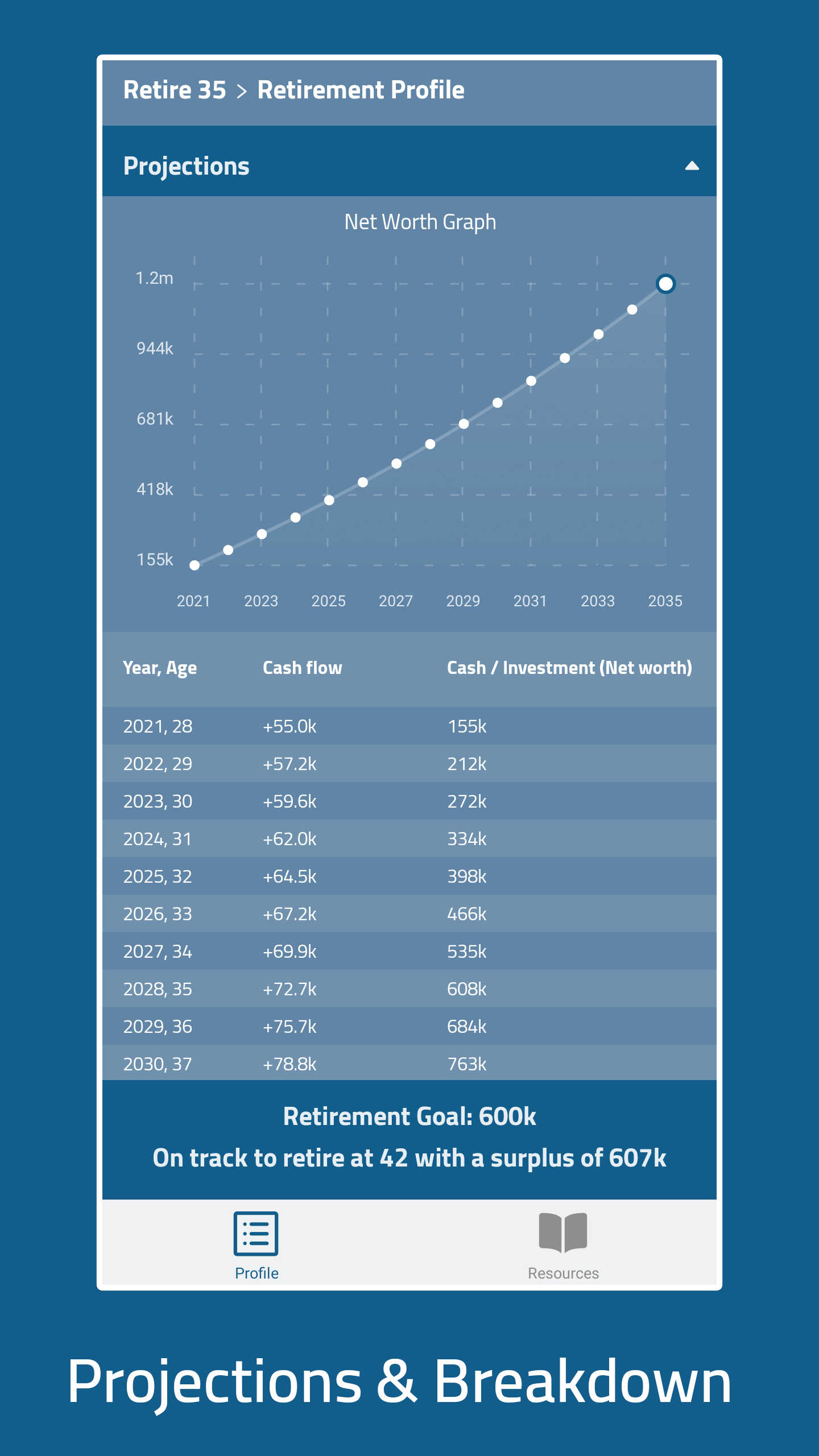

🎉🎉🎉 Retire 35 app is now available on Android and iOS!

Ever wondered how much money do you need to retire early (FIRE)?

You can now calculate the amount of money you need to retire early with **Retire 35** mobile app.

Download the **Retire 35** mobile app from the links below:

[](https://play.google.com/store/apps/details?id=com.paradite.retire35) [](https://apps.apple.com/us/app/retire-35/id1582600811)

# Retire at 35

## Key principles

**Retirement is a state of mind.**

With retirement, you know you have saved enough money to sustain the rest of your life.

**Retirement enables a new way of life.**

Retirement does not mean stop working. It simply means working is no longer about making money. Rather, it is about pursuing passion and interest.

This makes retirement meaningful, fulfilling and hopefully even more productive.

## Why retire early?

**Recover from long-term stress and burn-outs**

Working can be stressful, especially in the tech world where people are working long hours with intensive brain usage. This leads to stress and burn-outs and is not healthy in long-term. Retiring early provides an escape hatch from that.

**Sense of purpose and motivation**

It is easy to lose focus in work and get drown in endless feature requests, bug and technical discussions. By having a goal to retire, you can restore a sense of purpose to the work and become more motivated.

**Productivity and fulfillment**

In addition to the produtivity you gained from being motivated, you can also expect to be more productive even after achieving the retirement status. Afterall, you can do things you enjoy and there is no pressure on you to make money. This leads to more things being accomplished and a sense of fulfilment.

## Why 35?

35 is just a sample target. The idea is to retire (much) earlier than the society typically expects you to.

## What to do after retirement?

This is a common question asked about the goal of "Retire at 35".

The short answer: Without worrying about money and making the ends meet, it is really up to you to choose what to do.

Do you have something you are passionate about or interested in, but weren't able to pursue due to lack the time, money or opportunity? Retirement is a good starting point to revisit them.

If you are already working on your passion or interest, that's even better. You can continue doing what you are doing, just with an bonus peace of mind that you have the freedom to change if things don't go the way you liked.

If you are yet to discover your calling, don't worry. You can try out different things while you plan for your retirement. Afterall, planning and achieving retirement itself probably requires equal, if not more time than finding things to do after retirement.

One thing to note is that what you choose to do *after your retirement* might have an impact on your financial planning *before your retirement*.

Should you choose to do something that generates income, it would help with your overall financial status. On the flip side, if you want to pursue something that requires a lot of capital but produces little income (travelling around the world) or carries a significant investment risk (opening a cafe), you will need to factor that into your overall financial planning.

Here are some ideas to get the ball rolling:

* Art

* Learning and making [Origami](https://en.wikipedia.org/wiki/Origami)

* Learning and practicing freelance photography

* Content creation

* Writing books about your past experiences or cool ideas

* Making videos or podcasts

* Programming

* Build your own software products

* Becoming a full-time [open-source maintainer](https://github.com/readme/henry-zhu)

## How to achieve retirement at 35?

The formula is simple: `Money += Income - Spending`.

Hence the principles to retiring early are **earning enough income** and **spending wisely**. Some **calculations** are also required to get the exact numbers on a few variables.

You should not have to abandon your hobbies just to retire earlier. That's going against the very goal of early retirement. In fact, you should actively seek out hobbies while planning for early retirement.

### Earning enough income

Income refers to the money you get from your main job and side jobs (active income), and from your investment portfolio (passive income).

**Income - Main job**

Your main job has to generate high income in order for the rest of the content below to make sense. If you are reading this, chances are you work in the tech industry and you are in a pretty decent position to begin with. Otherwise, you have to find a way to enter one of the higher paid industries to get started.

I would suggest getting at least 100k USD annual basic salary (if you live in a major global city) to get started with the early retirement plans.

However, high paying job alone will not necessarily guarantee early retirement. There are plenty of other critical factors that I will go through below.

**Income - Total compensation**

If you want to retire early, you need more money from work on top of your basic salary. This can be in the form of bonus or stock. A good company with high potential growth can give you a high bonus or a lot of shares/stock options. These can bring up the total compensation signficantly or sometimes even be higher than the base salary.

[www.levels.fyi](https://www.levels.fyi/comp.html?track=Software%20Engineer) is an excellent platform to find out what's the general trend in the industry currently and what top companies or your target company is paying in terms of bonus and stock.

**Income - Investment**

Once you have enough seed capital from your main job, you can then use them in your investment portolio and watch them grow (hopefully).

Depending on your risk level, you can choose different options for your portofolio. Saving accounts from banks are usually the safest option but they usually offer lower returns. Stocks are the most volatile option, but they can sometimes give very high returns. This concept is called [*Risk-Return Tradeoff*](https://www.investopedia.com/terms/r/riskreturntradeoff.asp).

Don't limit yourself to just one or two options, you can combine a variety of them to build up your portfolio. This concept is called [*Asset Allocation*](https://www.investopedia.com/managing-wealth/achieve-optimal-asset-allocation/).

Here is a list of commonly used investment options:

* High interest saving accounts

* Robo-advisors

* Bonds

* ETFs

* Stocks

### Spending wisely

Spending is just spending. Anything in between income and spending is saved and work towards saving enough money for early retirement.

**Spending - Using Quota**

Set a reasonable quota for things that you don't really need, but always get tempted to buy:

* Buy a new phone at most once every 3 years

* Go for expensive meals at most twice every week

* Buy a new bag at most once twice a year

Once a rationale rule has been set, it should be harder for impulse purchase to happen.

**Spending - Calculate ROI for big-ticket items**

Before you make a decision to purchase a big-ticket item such as a house or a car, calculate its Return on Investment (ROI).

Consider the amount of money you can potentially save (or lose) by purchasing it. Of course we should also factor in the non-monetary benefits such having a peace of mind of not getting kicked out of your rented apartment by owning a house.

There are plenty of guides on the Internet on calculating whether it is worth it to buy a house (vs rent) or buy a car (vs using other means of transportation). Use them as a good starting point to make your own calculations and judgement. You might be surprised to find that renting for the whole time might be cheaper than buying a house.

## Planning, Calculations and Additional resources

How much money do you need to retire early?

Download the Retire 35 app on Android or iOS to calculate and start planning!

[](https://play.google.com/store/apps/details?id=com.paradite.retire35) [](https://apps.apple.com/us/app/retire-35/id1582600811)

Also enjoy curated resources on early retirement bundled within the app.

---

This is a collaborative effort. Issues and PRs are welcomed on the [GitHub repo](https://github.com/paradite/retire-at-35).

[Hacker News thread](https://news.ycombinator.com/item?id=29670581)