Ecosyste.ms: Awesome

An open API service indexing awesome lists of open source software.

https://github.com/themagicalmammal/stock-analyser

Simple to use interfaces for basic technical analysis of stocks.

https://github.com/themagicalmammal/stock-analyser

matplotlib numpy pandas seaborn statsmodels

Last synced: 7 days ago

JSON representation

Simple to use interfaces for basic technical analysis of stocks.

- Host: GitHub

- URL: https://github.com/themagicalmammal/stock-analyser

- Owner: themagicalmammal

- License: mit

- Created: 2022-04-10T11:17:00.000Z (almost 3 years ago)

- Default Branch: main

- Last Pushed: 2023-01-03T16:02:44.000Z (about 2 years ago)

- Last Synced: 2025-02-01T20:45:01.338Z (19 days ago)

- Topics: matplotlib, numpy, pandas, seaborn, statsmodels

- Language: Python

- Homepage: https://pypi.org/project/stock-analyser/

- Size: 1.02 MB

- Stars: 4

- Watchers: 2

- Forks: 1

- Open Issues: 0

-

Metadata Files:

- Readme: README.md

- License: LICENSE

Awesome Lists containing this project

README

# Stock Analysis

Package for making elements of technical analysis of a stock easier. This package is meant to be a starting point for you to develop your own. As such, all the instructions for installing/setup will be assuming you will continue to develop on your end.

## Usage

This section will show some of the functionality of each class; however, it is by no means exhaustive.

### Getting data

```python

from stock_analysis import StockReader

reader = StockReader("2017-01-01", "2018-12-31")

# get bitcoin data in USD

bitcoin = reader.get_bitcoin_data("USD")

# get faang data

fb, aapl, amzn, nflx, goog = (

reader.get_ticker_data(ticker) for ticker in ["FB", "AAPL", "AMZN", "NFLX", "GOOG"]

)

# get S&P 500 data

sp = reader.get_index_data("S&P 500")

```

### Grouping data

```python

from stock_analysis import group_stocks, describe_group

faang = group_stocks(

{"Facebook": fb, "Apple": aapl, "Amazon": amzn, "Netflix": nflx, "Google": goog}

)

# describe the group

describe_group(faang)

```

### Building a portfolio

Groups assets by date and sums columns to build a portfolio.

```python

from stock_analysis import make_portfolio

faang_portfolio = make_portfolio(faang)

```

### Visualizing data

Be sure to check out the other methods here for different plot types, reference lines, shaded regions, and more!

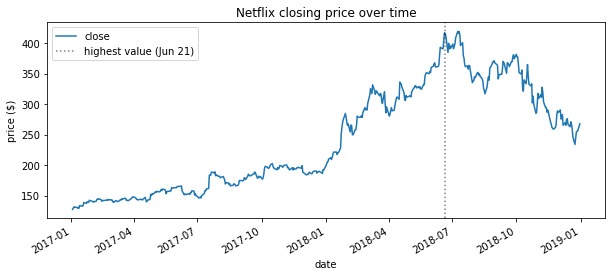

#### Single asset

Evolution over time:

```python

import matplotlib.pyplot as plt

from stock_analysis import StockVisualizer

netflix_viz = StockVisualizer(nflx)

ax = netflix_viz.evolution_over_time(

"close", figsize=(10, 4), legend=False, title="Netflix closing price over time"

)

netflix_viz.add_reference_line(

ax,

x=nflx.high.idxmax(),

color="k",

linestyle=":",

label=f"highest value ({nflx.high.idxmax():%b %d})",

alpha=0.5,

)

ax.set_ylabel("price ($)")

plt.show()

```

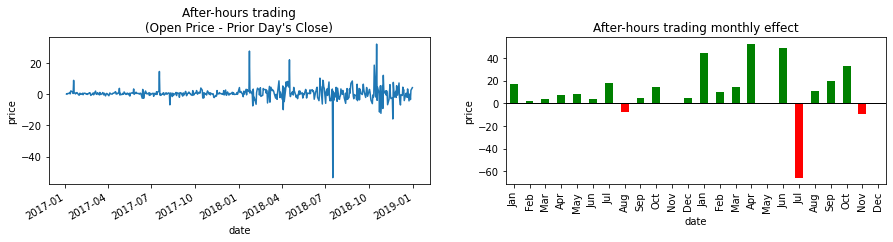

After hours trades:

```python

netflix_viz.after_hours_trades()

plt.show()

```

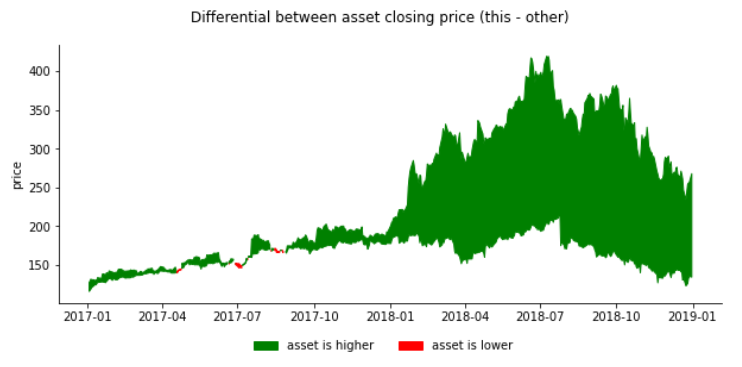

Differential in closing price versus another asset:

```python

netflix_viz.fill_between_other(fb)

plt.show()

```

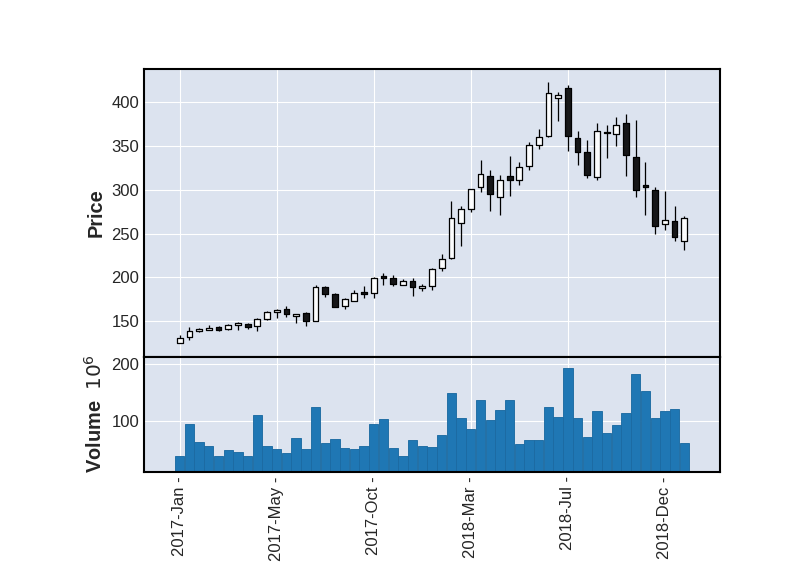

Candlestick plots with resampling (uses `mplfinance`):

```python

netflix_viz.candlestick(

resample="2W", volume=True, xrotation=90, datetime_format="%Y-%b -"

)

```

*Note: run `help()` on `StockVisualizer` for more visualizations*

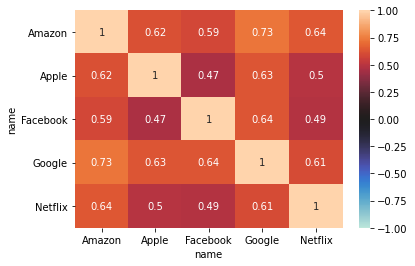

#### Asset groups

Correlation heatmap:

```python

from stock_analysis import AssetGroupVisualizer

faang_viz = AssetGroupVisualizer(faang)

faang_viz.heatmap(True)

```

*Note: run `help()` on `AssetGroupVisualizer` for more visualizations. This object has many of the visualizations of the `StockVisualizer` class.*

### Analyzing data

Below are a few of the metrics you can calculate.

#### Single asset

```python

from stock_analysis import StockAnalyzer

nflx_analyzer = stock_analysis.StockAnalyzer(nflx)

nflx_analyzer.annualized_volatility()

```

#### Asset group

Methods of the `StockAnalyzer` class can be accessed by name with the `AssetGroupAnalyzer` class's `analyze()` method.

```python

from stock_analysis import AssetGroupAnalyzer

faang_analyzer = AssetGroupAnalyzer(faang)

faang_analyzer.analyze("annualized_volatility")

faang_analyzer.analyze("beta")

```

### Modeling

```python

from stock_analysis import StockModeler

```

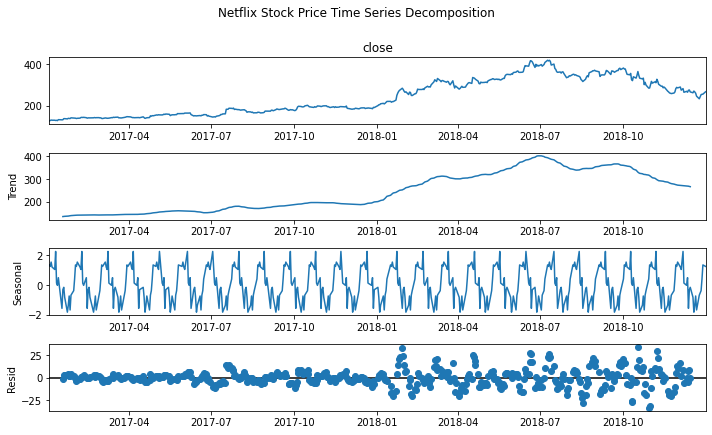

#### Time series decomposition

```python

decomposition = StockModeler.decompose(nflx, 20)

fig = decomposition.plot()

plt.show()

```

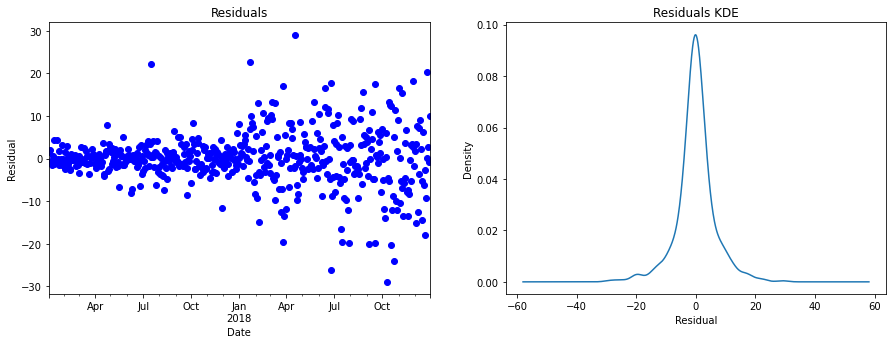

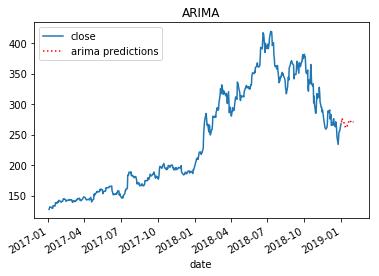

#### ARIMA

Build the model:

```python

arima_model = StockModeler.arima(nflx, 10, 1, 5)

```

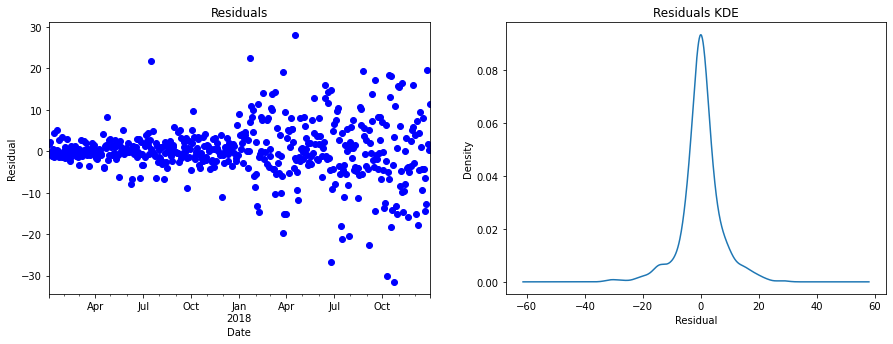

Check the residuals:

```python

StockModeler.plot_residuals(arima_model)

plt.show()

```

Plot the predictions:

```python

arima_ax = StockModeler.arima_predictions(

arima_model, start=start, end=end, df=nflx, ax=axes[0], title="ARIMA"

)

plt.show()

```

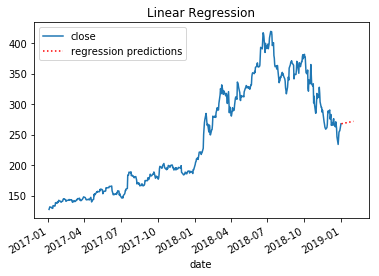

#### Linear regression

Build the model:

```python

X, Y, lm = StockModeler.regression(nflx)

```

Check the residuals:

```python

StockModeler.plot_residuals(lm)

plt.show()

```

Plot the predictions:

```python

linear_reg = StockModeler.regression_predictions(

lm, start=start, end=end, df=nflx, ax=axes[1], title="Linear Regression"

)

plt.show()

```