https://github.com/wowinter13/1000_and_1_project_ideas

A collection of business ideas/startups with some notions on their realizations.

https://github.com/wowinter13/1000_and_1_project_ideas

Last synced: 2 months ago

JSON representation

A collection of business ideas/startups with some notions on their realizations.

- Host: GitHub

- URL: https://github.com/wowinter13/1000_and_1_project_ideas

- Owner: wowinter13

- Created: 2020-12-09T17:47:36.000Z (over 4 years ago)

- Default Branch: master

- Last Pushed: 2021-06-08T09:58:18.000Z (almost 4 years ago)

- Last Synced: 2025-01-23T19:51:49.698Z (4 months ago)

- Homepage:

- Size: 2.79 MB

- Stars: 2

- Watchers: 4

- Forks: 0

- Open Issues: 0

-

Metadata Files:

- Readme: README.md

Awesome Lists containing this project

README

# One Thousand and One...Project Ideas

## Bio/Med-tech

### 1. First aid kit & Medication Tracker (Mobile)

| | |

| ------------- |----------|

| Geography | *RU* |

| Tags | *mobile* |

**Functionality:**

1. List all items in a kit

2. Notifications on expiration date

3. Pill reminder

**Additional monetization:**

1. (*) Search&Compare drug prices

2. No limit on notifications

### 2. Medical lootboxes

| | |

| ------------- |----------|

| Geography | *EU, RU* |

Why not to start with some vitamine combos from https://iherb.com?

Or check out: https://transcend.me/products/your-personalized-packets-11

### 3. Cheap lucid dreams mask

| | |

| ------------- |----------|

| Geography | *World* |

| Tags | *Kickstarter*, *Hardware* |

**Description**

*(A lucid dream is a type of dream where the dreamer becomes aware that they are dreaming. During a lucid dream, the dreamer may gain some amount of control over the dream characters, narrative, and environment. @Wiki)*

The lucid dreams mask is a type of smart mask, that tracks REM Sleep and causes lucid dreaming using audio or/and visual methods. Actually, there are at least two products currently on the market: Remee and Somni.

Remee's price is \$44.90 and it even **can't track** your eyes to define the REM phase. Somni's price is about **\$200.0**, but the product looks fine – they even added headphones for it. So we need to create a mask that is more functional than a Remee mask, but also is cheaper than a mask by Somni. How could we do it? Let's use heart rate monitors inside our smartwatches! During REM sleep, we can observe an overall increase in blood pressure and heart rate.

**MVP:**

1. Create an app to access and read your sleep data (https://www.appcoda.com/sleep-analysis-healthkit/)

2. Track any unstable heart rate increases and trigger a weak vibration on watches or (*)*send an event to a remote mask*; which now became much comfortable without heavy warm eye-tracking block on it.

3. (*) Create a mask 😃. (hint: check a technology behind the Spring water bottle)

**Why now?**

Because all existing solutions are too expensive or use obsolete technologies to track sleep phases. And the demand is quite stable.

****

## Invest-tech/Fin-tech

### 1. Quasi-broker

| | |

| ------------- |-------------|

| Geography | *EU, RU* |

| | |

### 2. Financial news/ideas/analytics aggregator

| | |

| ------------- |-------------|

| Geography | *World, RU* |

| Tags | *telegram* |

| | |

**Twitter data sources:**

1. (*RU*) @ArtCapitalTrade, @prime1, @onfleek419, @divalerts, @trader_book_news, @russianmacro, @Trade_The_News

2. (*International*) @barton_options, @DiMartinoBooth, @pat_hennessy, @biancoresearch, @CitronResearch, @profgalloway, @Fxhedgers, @old_but_works, @nntaleb, @muddywatersre, @govttrader, @jessefelder, @ThinkTankCharts

**MVP:**

At this stage, a Telegram/Twitter bot would be enough. For some inspiration, you could check these links: https://t.me/headlines_for_traders, https://t.me/fin_twitt, https://t.me/StockNews100

The only problem – possible news duplications, can be solved using algos such as `Word2vec` or `Doc2vec`.

**Functionality:**

1. A real-time news feed for traders

2. Filters on companies (*tickers*)

3. Filters on data types (*analytics, news, div calendar, etc.*)

### 3. Scouting for business jets

| | |

| ------------- |-------------|

| Geography | *World, US* |

| Tags | *alternative data*, *API*, *SaaS* |

Guys from Quandl did this trick.

1. They started tracking for Buffett's jets and watching all flights.

2. After that, they found companies' offices (*from the above cities*), where Berkshire Hathaway had some interest.

3. *Magic.* Sort all given data by flight quantity and frequency.

4. PROFIT: **Anadarko Petroleum**. Buffett had visited \$OXY a couple of times right before the $10 billion deal was publicly announced.

### 4. ML-darkpools

| | |

| ------------- |-------------|

| Geography | *World, US* |

| Tags | *alternative data*, *trade matching* |

**Description**

*(A dark pool is a privately organized financial forum or exchange for trading securities. Dark pools allow institutional investors to trade without exposure until after the trade has been executed and reported. Dark pools are a type of alternative trading system (ATS) that give certain investors the opportunity to place large orders and make trades without publicly revealing their intentions during the search for a buyer or seller. @Investopedia)*

When a trader places an order to buy stocks, the stock exchange matches it with a counter one to sell. ML middleware could split this order into smaller composite parts.

So we reduce the impact of the trade on the market price; optimizing the process of trading for big and complex positions.

**Why now?**

Here we have a strong interest from small/medium-sized funds, which can't use darkpools from such guys as Morgan Stanley or other big banks, but still don't want to move some penny stock prices (or emerging market stocks) simply because of portfolio rebalancing.

### 5. Advanced Backtesting

| | |

| ------------- |-------------|

| Geography | *World, RU* |

| Tags | *API*, *alternative data*, *SaaS* |

**Description**

Relatively speaking, that is a strategies' backtesting using data on crises and unexpected stock market crashes.

A platform that rafts your strategy through plenty of simulated crises, industry risk cases and can define some historical risk index for the total portfolio.

Also, we have some space to dream up ideas based on the intersection of value investing and stocks scoring. So we will be able to find out the best companies which can transcend any market difficulties.

**MVP:**

Let's be fair - it is just a simple pseudo stock exchange, that has the functionality to process (ETL) and reply data. Also, it could be a set of pseudo stock exchanges to train arbitrage strategies.

And the funny thing is – that you could find all these *Black Swan Events* or *alternative data* in countless different public sources.

**Why now?**

Let's have a look at this chart by Bloomberg. It's a little outdated, but it still looks actual. Every year the hedge-funds and biggest investment banks increase their spendings on technology and **quant strategies development** while cutting spendings on direct trading and front-offices.

In the world of algos and robots, it is getting harder and harder to trade discretionarily.

### 6. Mistaken tickers

| | |

| ------------- |-------------|

| Geography | *US, World* |

| Tags | *alternative data*, *SaaS* |

**Description**

1. Markets can stay irrational longer than you can stay solvent. (Keynes, 1930)

2. Apes together strong. (Rise Of The Planet Of The Apes, 2011)

Inefficient markets, combined with Robinhood apes, gift us with plenty of awkward and stupid market situations. One of them is a case when the original stock goes up while some other share with a similar ticker or name also starts to surge.

**MVP:**

1. Parse all stock tickers and their names (also, do not forget that you could have the same name on different exchanges).

2. Match all similar strings and create a dictionary for them (or create an index, it depends on how deep you plan to analyze the data)

3. Subscribe to real-time market data and track your dictionary keys (*key is a ticker of the original company*)

4. If the ticker swings more wildly in relation to the overall market (*regarding stock's beta*), create an alert (**or buy*).

5. (*or buy) As you understand, you easily could create a day-trading algo to track all market inefficiencies (for example, with Alpaca Markets API or IB API).

**Examples**

1. **\$DUO**: from \$10 to \$130 in 4 hours.

**FAANG** is an acronym referring to the stocks of the five most popular American technology companies: Facebook, Amazon, Apple, Netflix, and Google. Actually, there is no ETF's called \$FAANG (*the closest one is called \$XLC*). But new retail investors don't know anything about it. As a result, on 9 June 2020, we had \$DUO shares up nearly 395 percent. Why? Simply because Robinhooders heard everyone is buying FANG stocks and they rushed out and bought **FANG**DD *Network Group*, a Chinese company.

2. **\$GME** soared 60% in a day.

I'm almost sure that the original \$GME stock was also up 60% or more, but this \$GME is from Australia.

(In January, during Gamestop (\$GME) short-squeeze, company shares soared by a staggering 7000%)

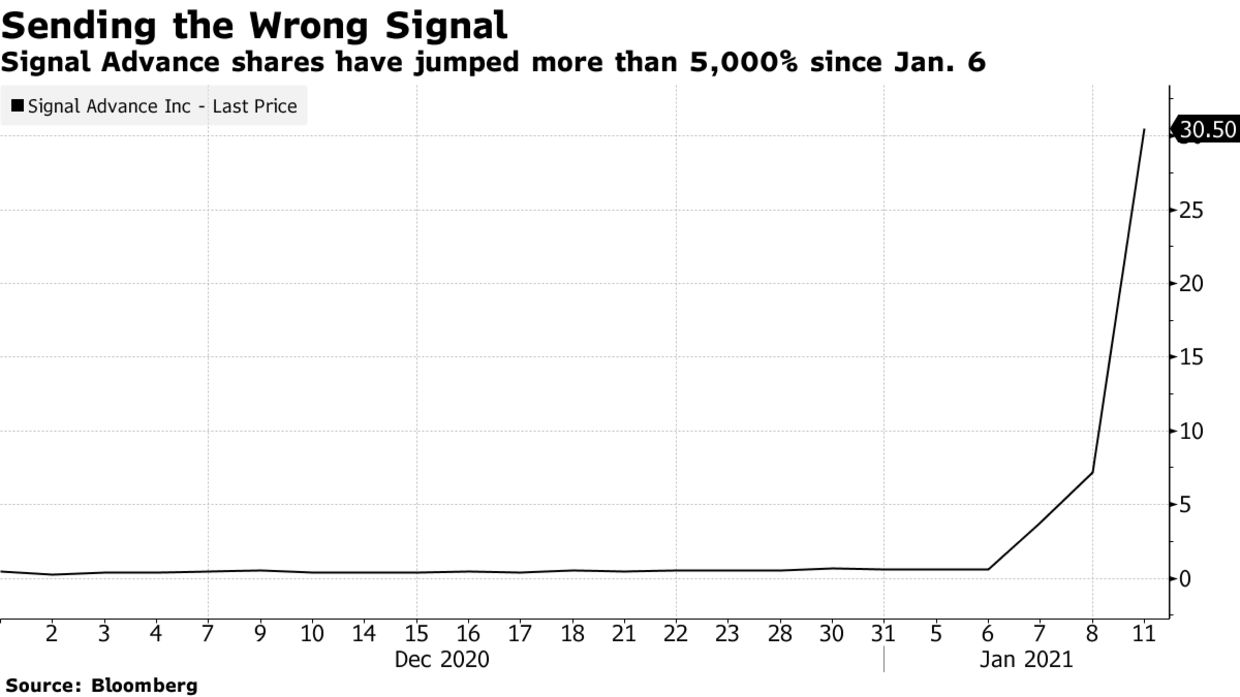

3. Elon signals to use Signal.

“*Use Signal,*” the Tesla Inc. CEO wrote on Twitter on Jan. 7. And it was referring to the encrypted messaging service...But by the end of the same day, **Signal Advance Inc** (\$SIGL) shares surged up 600%. And you may ask yourself, "What was wrong?". The signal was wrong. A two-word app recommendation from Elon Musk has turned into a massive rally in the shares of **a tiny medical device company** in another case of mistaken identity.

**Why now?**

“*Retail participation is at levels we haven’t seen in 20 years,*” said Benn Eifert, managing partner of QVR Advisors.

### 7. AI Open/Closed Ended Funds

| | |

| ------------- |-------------|

| Geography | *US, RU, World* |

### 8. Stock/Sector Arbitrage

| | |

| ------------- |-------------|

| Geography | *US, RU, World* |

This app simply identifies arbitrage opportunities. The price for the same instrument may differ on different stock exchanges. The app itself searches for such trades and notifies an investor.

### 9. Gaps on warrants

| | |

| ------------- |-------------|

| Geography | *US, RU, World* |

>Here was a trade. Nikola Corp., the maybe-one-day-electric-truck-maker that went public via a blank-check merger last month, has a lot of warrants outstanding. Each warrant (ticker NKLAW) allows you to pay \$11.50 to buy one share of Nikola common stock (ticker NKLA). The trade was:

1 Buy one warrant for \$24.62.

2 Pay $11.50 to exercise the warrant and get a share of stock.

3 Sell the stock for \$48.84.

You pay \$24.62 + \$11.50 = \$36.12. You get \$48.84. Your profit is \$12.72. Pretty good, no?

You can’t do this trade now. Those numbers are closing prices from Friday, back when the trade was good. The numbers are different now: The warrants closed yesterday at \$27.10; the stock closed at \$38.45. If you do the trade now you’ll lose 15 cents, never mind. Up until Friday you could do this trade and make a lot of money—Nikola shares got as high as \$79.73 on June 9, when the warrants closed at \$29.49, for a profit of \$38.74 on this trade—but now you can’t. The gap has closed.

>Here’s another approach: Just buy the warrant, don’t sell the stock, and wait. If the stock is worth \$48.84 on Friday, you might think, the best guess of its value on Monday is \$48.84, give or take. If you can pay \$24.62 on Friday for the right to acquire it for \$11.50 on Monday, for a total cost of \$36.12, then you are getting a good deal. Stock prices move around a bit, so you might not make exactly the \$12.72 profit implied by those numbers, but there’s a lot of room for error there.

That trade would have worked okay. If you bought the warrant for \$24.62 on Friday, you could have sold it for \$27.10 on Monday, for a profit of \$2.48. Not \$12.72, but greater than zero. Or you could have exercised the warrant on Monday, gotten the stock, and sold the stock for \$38.45, for a profit of \$2.33. The problem is that the main assumption of the trade was mostly wrong: The stock was worth \$48.84 on Friday, but it collapsed to \$38.45 on Monday.

One classic way would be: Buy the warrant, sell the stock short, and wait. If you bought the warrant for \$24.62 and sold the stock short for \$48.84, you would have collected \$24.22 in cash. You’d sit on that cash for a weekend, the warrants would become exercisable on Monday, you’d pay \$11.50 of your cash to exercise, you’d get back a share of stock and deliver it to close out your short, and you’d keep \$12.72. Nice trade.

That is not rocket science to compute the difference between a fair value of the warrant and market value.

****

## Common

### 1. Vinyl lootboxes (or subscription)

| | |

| ------------- |-------------|

| Geography | *World, RU* |

| Design | https://dribbble.com/shots/6255851-SQUARE-Interaction-Vol-3 |

**Why now?**

*In 2016, vinyl sales hit a 28-year high – and there’s no slowing it down! Maybe it’s time to restart the business model.*

(Source: https://fortune.com/2016/04/16/vinyl-sales-record-store-day/)