https://github.com/yellowbean/AbsBox

a cashflow engine wrapper for structured finance professionals

https://github.com/yellowbean/AbsBox

abs cashflow clo mbs modeling structured-finance structuring

Last synced: 8 months ago

JSON representation

a cashflow engine wrapper for structured finance professionals

- Host: GitHub

- URL: https://github.com/yellowbean/AbsBox

- Owner: yellowbean

- License: apache-2.0

- Created: 2022-06-20T17:09:33.000Z (over 3 years ago)

- Default Branch: main

- Last Pushed: 2025-03-22T07:12:47.000Z (10 months ago)

- Last Synced: 2025-03-22T09:08:21.786Z (10 months ago)

- Topics: abs, cashflow, clo, mbs, modeling, structured-finance, structuring

- Language: Python

- Homepage: https://pypi.org/project/absbox/

- Size: 23.2 MB

- Stars: 51

- Watchers: 6

- Forks: 10

- Open Issues: 9

-

Metadata Files:

- Readme: README.md

- Changelog: CHANGELOG.md

- License: LICENSE

Awesome Lists containing this project

- awesome-quant - AbsBox - A Python based library to model cashflow for structured product like Asset-backed securities (ABS) and Mortgage-backed securities (MBS). (Python / Financial Instruments and Pricing)

- awesome-quant - github.com/yellowbean/AbsBox

README

# AbsBox

a structured finance cashflow engine wrapper for structured credit professionals:

* transparency -> open source for both wrapper and backend engine, great variable inspection support.

* human readable waterfall -> no more coding/scripting, just *lists* and *maps* in Python !

* easy interaction with Python numeric libraries as well as databases/Excel to accomodate daily work.

[](https://badge.fury.io/py/absbox)

[](https://img.shields.io/pypi/dm/absbox)

## installation

pip install absbox

## Documentation

* English -> https://absbox-doc.readthedocs.io

* Chinese(inactive) -> https://absbox.readthedocs.io

## Goal

* Structuring

* Easy way to create different pool assets/deal capital structures and waterfalls

* User can tell how key variables(service fee/bond WAL/bond cashflow etc) changes in different structure of transactions.

* Investor

* Given powerful modelling language to build cashflow model , user can price bonds of transaction with pool performance assumption

## What it does

* Provide building blocks to create cashflow models for ABS/MBS

* Adapt to multiple asset classes

* Residential Mortgage / AdjustRateMortgage/ IO,PO,Balloon Mortgages / Auto Loans

* Corp Loans

* Consumer Credit

* Lease (For CMBS)

* Fix Asset (Solar Panel/Hotel)

* Receivable

* SRT/Siginificant Risk Transfer

* Master Trust

* Features

* Sensitivity Analysis on different scenarios or deal structures

* sensitivity analysis on pool performance assumptions

* sensitivity analysis on capital structures or any deal components

* Bond Cashflow/Pool Cashflow Forecast, Pricing

## What it takes to master

* Python syntax, nice to have knowledge of functional programming ,or exposure to package `toolz`/`lenses`

* Patience & Persistence, but remember , there is a slack community and responsive support !

## Missing Features ?

Raise issues or disucssion with the prospectus or spreadsheet how asset cashflow should be projected.

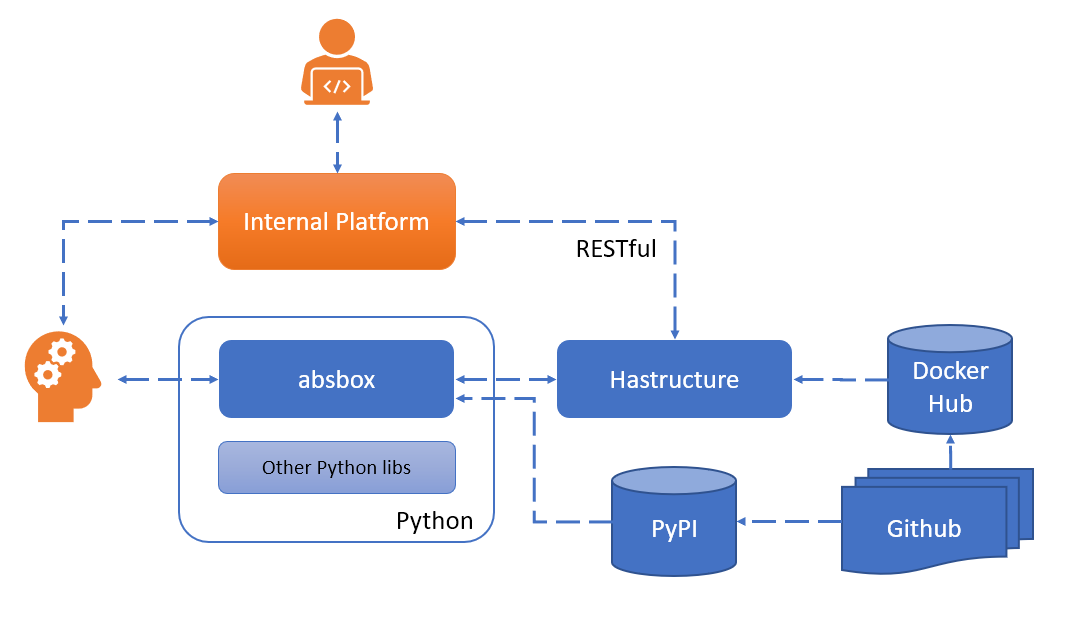

## Data flow

## Data Privacy

User can have option to connect to a private calculation engine in his/her own environment

## Community & Support

* [Discussion](https://github.com/yellowbean/AbsBox/discussions)

* [Slack](https://absboxhastructure.slack.com)

## Misc

#### Proposed Rule regarding Asset-Backed Securities: File No. S7-08-10